Education Software in Today’s Schools: Sector Trends and M&A Insights

Like many other facets of society, the Education Software sector is undergoing significant transformation driven by the digital revolution. Over the last two decades, America’s school systems have aggressively pursued technological solutions to help improve the quality of educational programming, expand access to underserved communities, and streamline administrative processes.

The COVID-19 pandemic accelerated the trend, necessitating the adoption of remote and hybrid learning models, virtual classrooms, online tools, and EdTech platforms to cater to diverse populations. Today, the transformation continues as cloud-based SaaS solutions equip institutions with intuitive and cost-effective tools to empower teachers and students, enable collaboration, and modernize the business of education at every level.

In short, technology is changing the face of Education as we know it, and software is playing a leading role. Not surprisingly, this evolutionary process has created a healthy marketplace for software M&A transactions, opening doors of opportunity for SaaS entrepreneurs.

In this article, we will take a closer look at the issues facing educational institutions, how they are using software to achieve their goals, and what it all means for software companies.

The Education Landscape

To fully grasp the enormous breadth of opportunities for software to reshape the Education sector, companies should start with at least a fundamental understanding of the current landscape. For the sake of market analysis, the Education sector is typically divided into two broad categories: K-12 and higher education (colleges and universities). It is important to understand that these markets stretch far beyond the physical walls of classrooms to encompass administrative and support functions, as well as the vast universe of online learning through non-traditional channels.

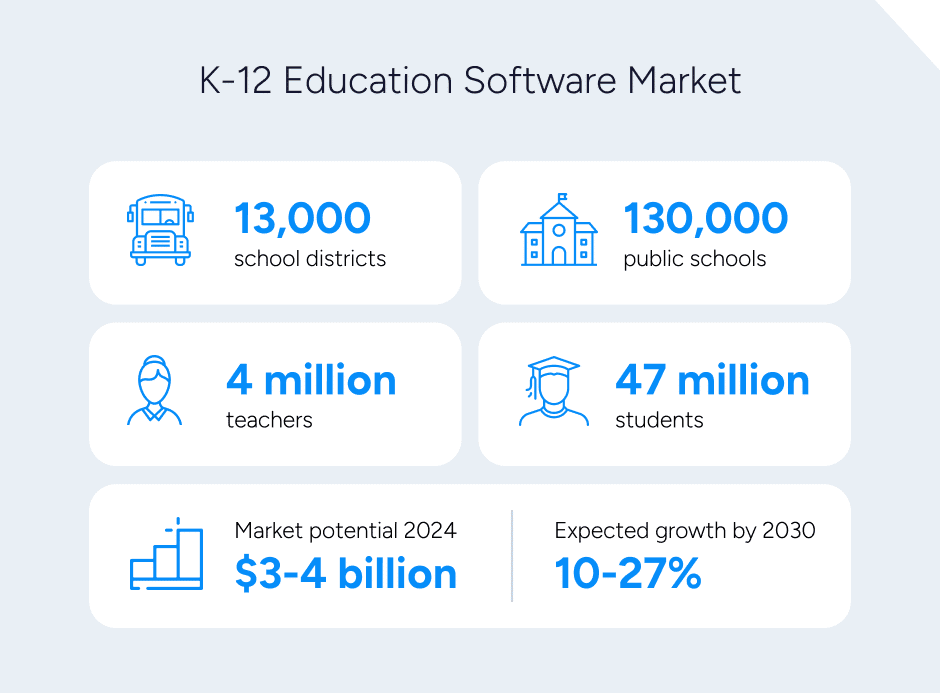

K-12 Education Software

The K-12 market comprises more than 13,000 school districts, nearly 130,000 public schools, 3-4 million teachers, and 47 million students. This ubiquitous system is estimated to present a technology market of $3-4 billion as of 2024 and is expected to grow by 10-27% by 2030.

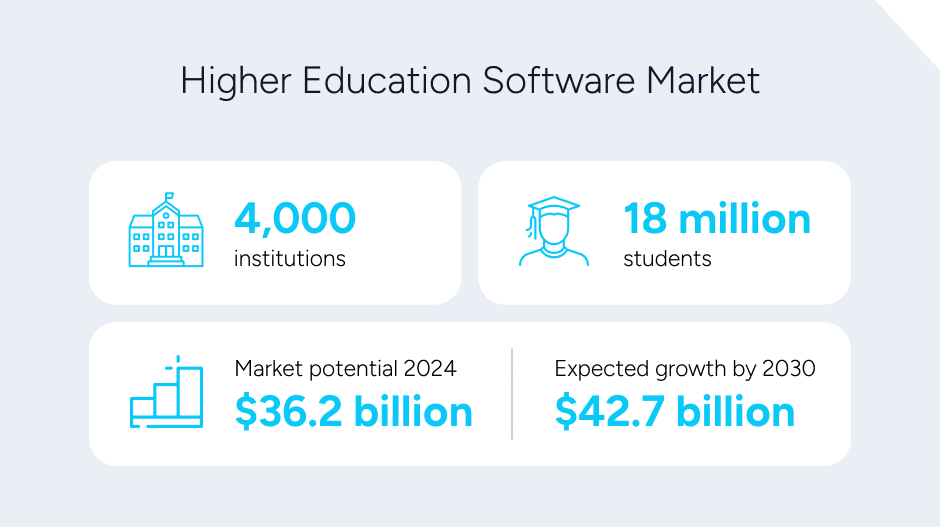

Higher Education Software

Compared to K-12, the higher education category is smaller – with roughly 4,000 institutions serving 18 million students – but it represents a much larger market for technology businesses. In 2022, the higher-ed tech market was estimated to be about $36.2 billion and is projected to grow to $42.7 billion by 2030.

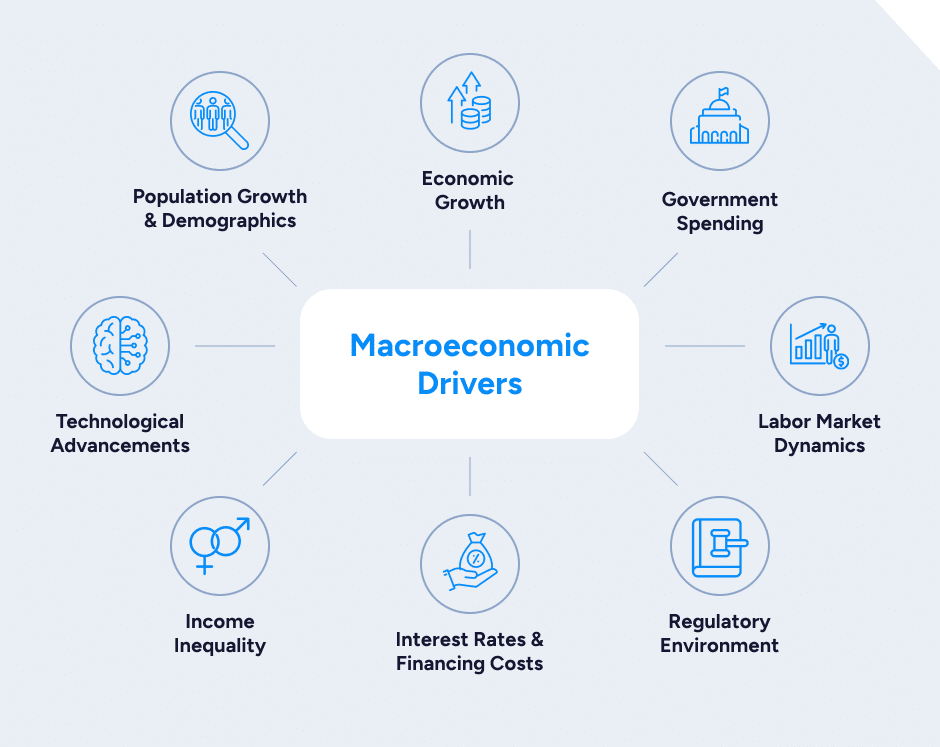

Macroeconomic Factors to Consider

Before diving into the specific drivers of growth, it’s also worth noting that the education system is inextricably linked to an even larger, complex ecosystem of macroeconomic factors. The sector is deeply intertwined with broader economic trends, from the ebbs and flows of economic growth to the intricacies of government budget allocations.

For example, labor market dynamics and demographic shifts influence the types of skills and knowledge in demand, while income inequality and regulatory frameworks play pivotal roles in determining access to quality education and the overall functioning of educational institutions.

In the following sections, we will explore how these sweeping influences combine to create opportunities and challenges for educational institutions.

Headwinds: Challenges Facing the Education Sector

Generally speaking, America’s educational system is expanding. There are more people, and thus more students and more schools than ever before. Thanks to technology, there are also more ways to learn than ever before. However, these realities also create growing pains and introduce complexities that threaten the stability of institutions across the educational spectrum.

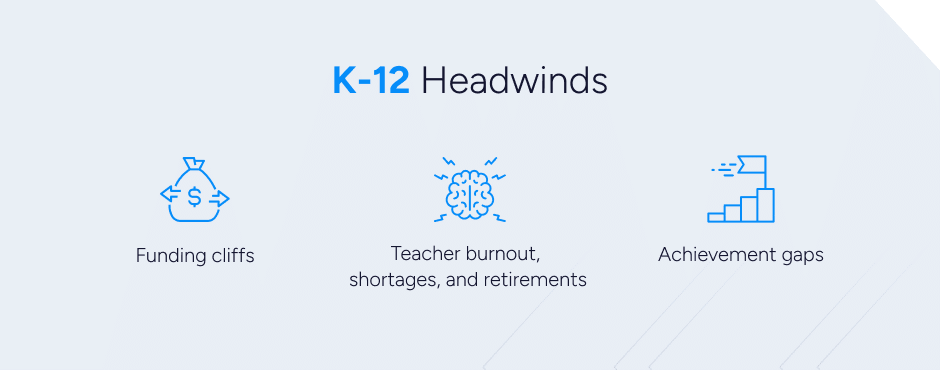

K-12 Sector Challenges

In the K-12 sector, school systems are finding it more difficult than ever to provide a high-quality education at sustainable costs. They currently face the expiration of federal relief funds issued during the pandemic. Their budget woes are compounded by state tax cuts, the diversion of funds to voucher programs, inadequate funding formulas, and inflation-driven costs.

At the same time, many school systems face labor shortages as some teachers retire, others burn out, and there aren’t enough qualified candidates to replace them. This problem only exacerbates achievement gaps (disparities in academic performance between districts), which widened during the pandemic.

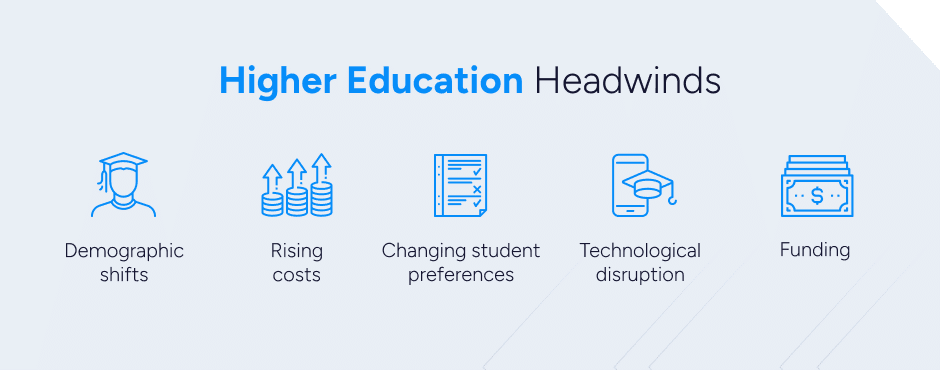

Higher Education Sector Challenges

Meanwhile, higher education institutions are working to address several long-term trends that are changing the way America thinks about college. Due to ever-rising tuition costs (further fueled by recent inflation), families are questioning the return on investment (ROI) of traditional degrees, and students are increasingly seeking alternative credentials.

An explosion of online learning platforms and alternative education providers are challenging traditional models and competing with long-established universities for students. To succeed in the future, institutions will need to clearly demonstrate their value while finding ways to control costs.

A common theme running through all levels of education is the need to do more with less, which is where technology and software thrive.

Tailwinds: Positive Forces Enabling Progress

While the Education sector certainly has obstacles to overcome, there are also plenty of reasons to be optimistic. These reasons, in turn, present promising opportunities for software providers.

K-12 Sector Opportunities

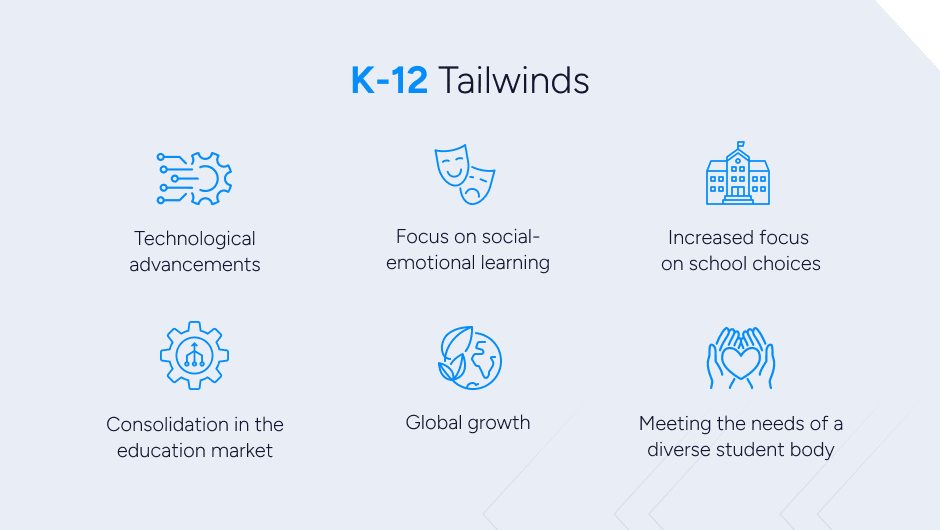

At the K-12 level, there’s a growing focus on providing more choice and personalization in the way children are educated. This includes changing policies that give parents more say in where their kids attend school (which could be online-only), as well as customized programs that better accommodate diverse cultures and languages.

Furthermore, some schools are moving beyond traditional academics to emphasize social-emotional learning curricula. Technical infrastructure and SaaS solutions are facilitating these and other changes in the education landscape.

Higher Education Sector Opportunities

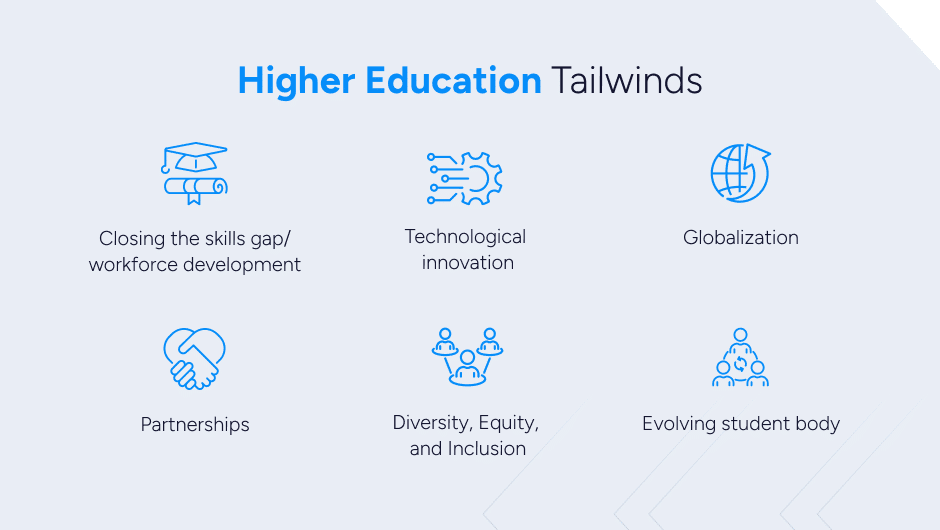

Colleges and universities are also adapting to a more diverse student body, which not only includes a multitude of races, ethnicities, and languages but also different gender identities and wide-ranging age groups. They’re catering to a growing contingent of older adults who seek lifelong learning and skill development and forming partnerships with corporations to bridge the divide between school and work.

Moreover, universities are counteracting increased competition from non-traditional programs with their own expansive online offerings, enabling them to serve a worldwide study body. All of these innovations are (or can be) further enhanced through education-focused software solutions.

Digital Transformation Drives M&A in Education Software

The education software trends we have discussed so far reveal some unique entry points where software providers can bring value to education organizations. But there are also a number of broader technological trends that are driving digital transformation across every industry, education included.

Here are three general areas where SaaS providers are helping the Education sector transform:

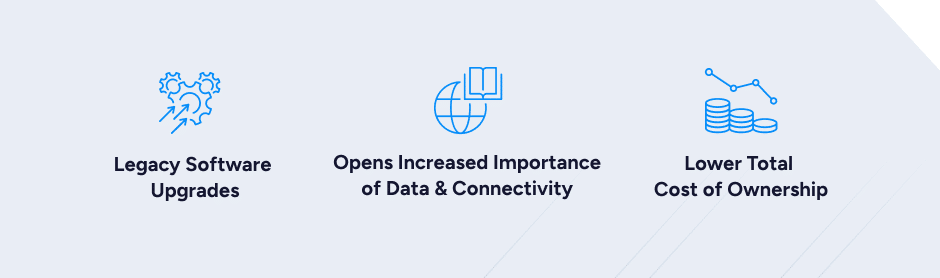

- Upgrading Legacy Systems. The transition from on-premise Educational software to cloud-based SaaS solutions has accelerated over the past decade. While on-premise software is still present in some schools – common systems include LMS, ERP, SIS, and some educational games – the trend has been steadily moving towards the cloud.

- Enabling Data-Driven Operations. As in other industries, the education environment can now create vast quantities of data from smart assets, sensors, and systems. This capability has become increasingly valuable in operations-focused areas such as real estate and facilities management. Often aided by artificial intelligence and machine learning, the captured data can be used to drive predictive and prescriptive maintenance on equipment and facilities, optimize to reduce water and energy use, and many other applications. SaaS gives education organizations the tools to harness this data to help control costs and hit budgets.

- Lowering Software Costs. SaaS reduces the total cost of ownership (TCO) compared to on-premise software by eliminating upfront costs for hardware, software licenses, and IT staff for maintenance. Subscription models can also make budgeting more predictable, often moving from CapEx to OpEx expenditures. As schools grow, scalability is far easier with SaaS.

As SaaS companies have emerged as prime candidates to meet these near-universal needs for educational institutions, private equity firms and strategic buyers have taken notice and are eager to capitalize.

M&A Activity to Watch in Education Software

Opportunities abound for SaaS providers in the Education space, and it is bringing several types of buyers to the table. In recent years, M&A transactions involving Education software companies have been higher, on average, compared to pre-pandemic years. Transactions in 2023 (54 in total) declined from the “peak” year of 2022 (67 transactions), but 2024 is shaping up to be another strong year.

Some of the hottest software specializations attracting buzz in the M&A market include personalized solutions (to meet diverse academic needs); administrative solutions (such as data analysis and reporting); operational and strategic capital improvements (such as building and facilities management); and communication and compliance platforms (for enhanced record keeping).

Regarding buyer trends, private equity investors have emerged as predominant players in the Education software sector, with over 60% of deals driven by PE buyers over the past five years.

Exit Opportunities for Education Software Companies

Organizations across every facet of the Education sector are in dire need of technology to help them meet students’ academic needs and cut down on rising operational costs. In the years ahead, SaaS solutions will play a pivotal role in accelerating digital transformation in support of these goals. For these reasons and more, Education Software businesses have never been in a better position to negotiate a potential M&A transaction.

To learn more about how your software company can capitalize on these trends and improve its valuation, contact our M&A experts and get started with a complimentary Strategic Assessment.

Other Vertical-Specific Blog Posts to Read: