How the Digital Transformation Drives M&A Activity in Manufacturing

After a gradual decline since the mid-20th century, the U.S. manufacturing and industrial sector is making a comeback. Challenges like global competition, rising wages, and outsourcing led to losses, with the most significant drop between 2000 and 2010. Now, signs of recovery are emerging. And that spells opportunity for SaaS companies focused on helping producers streamline and optimize their operations.

Manufacturers and industrial companies are experiencing a resurgence fueled by a combination of trends, including reshoring, legislative mandates, and other macroeconomic factors. In March 2024, the U.S. Purchasing Managers Index (PMI) moved into expansion territory following 16 consecutive months of contraction. Survey respondents noted positive trends such as strong demand, potential growth, and stability in commodity prices. These are clear signs of improvement in the sector, aligning with other positive indicators for the U.S. economy.

As industrial businesses look ahead to better times, they’re accelerating their pursuit of digital transformation in manufacturing and Industry 4.0 technologies. SaaS, of course, plays a central role in these efforts, driving a heightened level of M&A activity in the software space.

SEG’s 2024 report on the State of Industrial/Manufacturing Software examines these latest developments and the trends and drivers impacting the sector. This article offers an overview of key findings from the report and insights into how SaaS companies can capitalize on potential exit opportunities.

M&A Overview: The Quest for Industry 4.0

Over the last decade, the industrial business landscape has undergone significant change, propelled by the push for digital transformation in manufacturing and the advent of Industry 4.0 technologies. Digital transformation typically refers to the mass adoption of new technologies and automated processes for solving business and operational challenges and fueling opportunities. In the manufacturing and heavy industry world, digital transformation is nearly synonymous with the vision of achieving Industry 4.0. As IBM describes it, Industry 4.0 enables automation and business intelligence that manufacturers use to make products faster, cheaper, and smarter. Cloud computing, AI and machine learning, advanced analytics, and Internet of Things (IoT) technologies contribute to this trend.

Here are just a few ways that Industry 4.0 streamlines processes in a manufacturing or industrial setting:

- Harnessing data from many sources in the digital and physical world enables better data-driven decisions

- Overarching views of supply chains, customer service platforms, and enterprise systems via data aggregation tools added by AI

- Real-time visibility into production, quality, environmental impact, and other areas driven by advanced manufacturing operational systems

- Reduction in profit-killer unplanned downtime by leveraging predictive and prescriptive maintenance

As companies eagerly pursue all the benefits of digital transformation in manufacturing, SaaS solutions in this space have experienced a correlated surge in demand. Solutions that integrate AI and bridge the physical and digital worlds are especially sought after due to their potential to enhance functionality, improve efficiency, and provide valuable insights for manufacturers. These transformative technologies run across various software domains, including ERP, EAM, MES, QMS, and SCM.

Consequently, the growing demand for these SaaS solutions strongly influences the M&A landscape. 2019 saw 49 SaaS acquisitions in the manufacturing/industrial space, compared to 67 in 2023. Strategic buyers and PE firms recognize the opportunity to reap significant rewards from digital transformation.

Converging Trends Driving M&A Activity

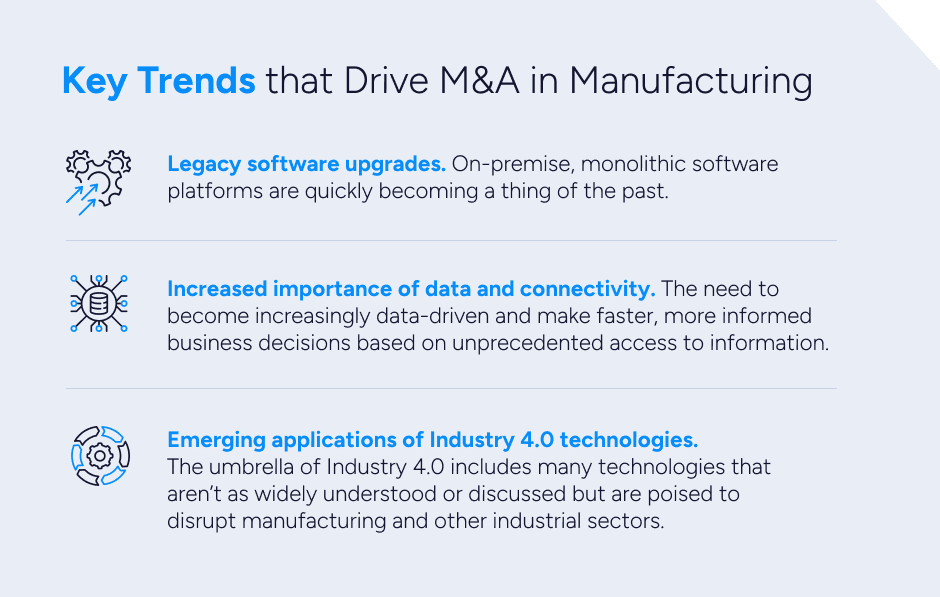

In addition to the tailwinds provided by digital transformation trends in manufacturing, increased SaaS M&A activity can also be attributed to several related factors. These include:

- Legacy software upgrades. On-premise, monolithic software platforms are quickly becoming a thing of the past. While a small minority of very large or very specialized organizations still need to maintain legacy applications and architecture, most manufacturers and other industrial companies see that SaaS solutions, with their flexibility and scalability, are the way of the future. If they haven’t upgraded already, it’s high on the priority list for most organizations, prompting more M&A activity.

- Increased importance of data and connectivity. Nearly every industry on the planet is becoming increasingly data-driven and able to make faster, more informed business decisions based on unprecedented access to information. These capabilities, long out of reach for industrial companies bound to the physical world, are now used to enhance operations in factories, refineries, warehouses, and construction sites. Organizations can closely monitor equipment performance, remove bottlenecks, and optimize preventive and prescriptive maintenance through a combination of interconnected smart assets, sensors, and systems. SaaS solutions help industrial companies integrate connected devices and harness and visualize their data, unlocking new levels of efficiency and business intelligence.

- Emerging applications of Industry 4.0 technologies. In its many forms, AI is grabbing all the headlines of late, and machine learning and IoT are nearly as well-known in industrial circles. However, the umbrella of Industry 4.0 includes many technologies that aren’t as widely understood or discussed but are poised to disrupt manufacturing and other industrial sectors. These include, among others, additive manufacturing (3D printing), blockchain, and virtual/augmented reality, for which companies are finding new and exciting uses daily. SaaS has a significant role in making these technologies accessible and intuitive for business users.

Ultimately, the digital transformation in manufacturing and industrial companies, fueled by competitive pressure to exist at the cutting edge of technology, will drive more demand for SaaS solutions and increase M&A transactions.

Buyer Activity: Who’s Acquiring Manufacturing/Industrial SaaS companies?

Beyond the heightened level of M&A activity in recent years, the manufacturing/industrial software sector has also seen a shift in acquisition dynamics. Historically, strategic buyers have dominated the space, conducting the majority of transactions each year from 2019 to 2021. However, private equity buyers have surged forward over the past two years, accounting for 54% in 2022 and 63% in 2023.

This change can be attributed to PE firms recognizing the massive potential of SaaS companies in this space, whether they have a well-established operation or represent a ripe opportunity for innovation and value creation. As such, PE firms are leveraging their abundant resources to make aggressive moves.

With a large total addressable market eager to adopt new technologies and supporting software, both PE investors and strategic buyers maintain great interest in this sector.

Major M&A Deal Highlights

The past two years have seen several intriguing transactions that shed additional light on what could be possible for SaaS businesses in the manufacturing/industrial space. A few examples include:

- In 2022, Siemens acquired Brightly Software (formerly Dude Solutions), which provides enterprise asset management and facility operations management SaaS. Siemens said they will integrate Brightly’s solutions with their solutions to support the “vision of creating fully autonomous buildings that continuously learn from and adapt to the needs of their tenants.”

- In 2023, Fluke, a maker of electronic testing and thermal imaging equipment, purchased Symphony AI, specializing in SaaS for machine condition monitoring. The acquisition complements Fluke’s wide-ranging capabilities in supporting its customers’ predictive maintenance and connected reliability needs.

- Also, in 2023, QAD, already a leader in the industrial software space with various ERP, SCM, and CRM offerings, expanded its portfolio to include workforce management and collaboration SaaS with the purchase of Redzone.

Seize Your Opportunity in Manufacturing/Industrial M&A

As the pursuit of digital transformation in manufacturing and Industry 4.0 continues to drive demand for integrated software solutions, opportunities abound for well-run SaaS businesses. For a deeper dive into current trends impacting the M&A climate, please download our 2024 State of Industrial / Manufacturing Software Report.

If your business is contemplating exit opportunities, don’t hesitate to contact SEG for assistance. Our expert advisors can help your company understand its potential valuation and recommend steps to achieve an optimal M&A outcome.