The 6 Digital Marketing Trends Powering Our Strategy (and How They Can Power Yours Too)

When I was the CMO of iOffice, a niche SaaS workplace management solution now called Eptura, we grew the company from $2M to $102M through organic growth and strategic acquisitions. Marketing was more than generating leads; it shaped brand perception, accelerated deal velocity, and attracted investors and buyers.

That experience taught me something most software founders eventually discover: digital marketing trends directly influence growth, valuation, and exit outcomes.

The challenge is that trends shift fast. Founders ask us all the time:

- Which digital marketing strategies are best for B2B SaaS?

- Where should we invest when budgets are tight?

- How do we balance AI, personalization, and authenticity without wasting time or money?

This post answers those questions by breaking down the six biggest digital marketing trends shaping SaaS today. Each one matters because it ties to revenue growth, buyer trust, or enterprise value, the metrics that drive real outcomes for SaaS founders and CEOs.

Trend #1: AI Adoption in Marketing is Accelerating at Record Speed

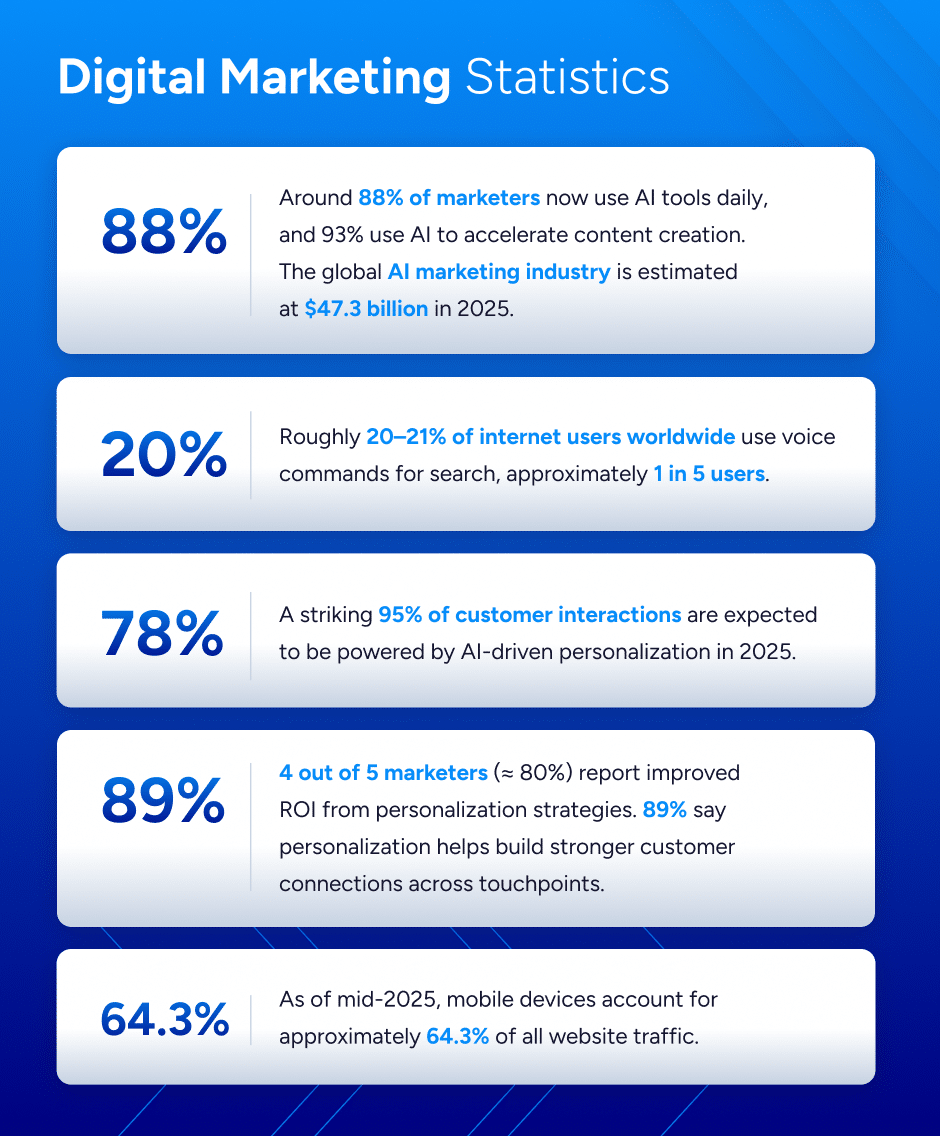

AI is no longer an emerging technology in marketing—it’s mainstream. Twenty-eight percent of top companies already use AI in marketing, and the market is expected to hit $48.8 billion by 2030. From content creation to campaign optimization, AI is reshaping how SaaS companies reach and convert buyers.

The martech landscape reflects this explosion. According to the MartechMap, the number of marketing technology solutions grew by another 9% this year to 15,384 tools. While new AI-native startups keep launching, the previous generation of platforms is consolidating, creating both opportunity and complexity for SaaS founders trying to pick the right stack.

For founders, the implications are big:

- Faster execution: Tasks like ad testing, SEO optimization, and basic content drafting can be automated.

- Smarter targeting: AI analyzes buyer behavior in real time, improving personalization.

- Better resource allocation: Teams can focus on strategy instead of repetitive work.

At SEG, we’ve embraced this shift. Opus helps us repurpose webinars into short-form videos for LinkedIn and YouTube, while Clay.com enriches CRM data and automates market map creation. We also use AI to accelerate sector report research to get insights into our audience’s hands faster.

One caution, though, is that AI content tools like ChatGPT are powerful but imperfect. They streamline research, idea generation, and first drafts, but we always layer in human expertise and voice, so the final product is accurate, authentic, and valuable to our audience.

Trend #2: Conversational AI & Real-Time Personalization Are Reshaping the Buyer Journey

Traditional personalization, segmenting by industry, job title, or ARR, no longer meets buyer expectations. Modern SaaS founders want real-time, self-directed experiences that surface the right answers instantly, without waiting for a demo or digging through a blog archive.

This is where conversational AI takes personalization to the next level. Instead of static landing pages, companies are building AI-powered agents on their websites so visitors can:

- Ask specific questions like “What drives SaaS valuations?” or “Do you have benchmarks for ARR growth?”

- Query live datasets, like “How many deals closed in PropTech last quarter?” or “What valuation multiples are trending in healthcare SaaS?”

- Get real-time analysis and strategic context, not just links to existing resources.

For founders, this shift matters because:

- Insights become interactive: Buyers explore data, trends, and strategic implications at their own pace.

- First-party data becomes richer: Every question signals what the market wants to know, informing content and product roadmaps.

- Decision-making accelerates: Instead of waiting on reports or calls, founders get instant context for big strategic questions like exit timing or valuation benchmarks.

At SEG, we’re building this capability into our site so SaaS founders can instantly analyze our deals database, sector reports, and benchmarks through natural language queries. It will transform our content from a static library into a real-time decision-support system for the SaaS market. Stay tuned!

Trend #3: SEO Is Shifting Toward “Answer Engine Optimization”

Traditional SEO isn’t dead, but it’s changing fast. Generative AI, voice search, and conversational interfaces mean buyers now expect direct, contextual answers rather than scrolling through pages of links.

This evolution turns SEO into what many now call Answer Engine Optimization (AEO). Instead of chasing keywords, companies must focus on:

- Questions buyers actually ask about solutions, ROI, and industry benchmarks.

- High-value content that AI systems can summarize in search results or chat-based interfaces.

- Visuals and interactive tools that enhance discoverability across formats.

At SEG, we’ve shifted to this model. Our blogs, valuation tools, and sector reports are structured to answer the exact questions SaaS founders type into Google or ask ChatGPT about growth, valuation, and M&A timing.

And here’s why that structure matters:

LLMs like ChatGPT and CoPilot analyze:

- The order in which information is presented

- The hierarchy of concepts (headings still matter)

- Formatting cues like bullet points, tables, and bolded summaries

- Redundancy and reinforcement, which help models determine what’s most important

Poorly structured content, even if keyword-rich, rarely shows up in AI summaries. If you want your company cited as an expert source, you need a content plan with FAQs, clear headings, summaries, and schema markup so AI tools can easily understand and surface your insights.

This is where Answer Optimization goes beyond traditional SEO; it’s about making your expertise machine-readable so buyers see you first, whether in Google search results or an AI-generated briefing.

Trend #4: Video Is Moving from Awareness to Revenue Engine

Video has always been good for brand awareness. What’s changed is how buyers and investors evaluate companies and how platforms are prioritizing it in search and social algorithms.

Recent data shows this shift clearly. Seventy percent of B2B buyers engage with video content during their purchase journey, and 99% say video helps close deals and 93% say it builds brand trust. Companies using video even report 49% faster revenue growth than those that don’t, according to Brightcove.

Platforms are responding too. LinkedIn has seen a 36% year-over-year increase in video views, and short-form formats like Reels now account for 30% of video consumption on Facebook.

This shift means video is a credibility and conversion driver. A strong video library lets prospects self-educate, accelerates sales cycles, and gives investors on-demand access to founder perspectives, customer stories, and thought leadership clips.

At SEG, we’ve turned client interviews into long and short clips for YouTube, LinkedIn, and email, driving higher engagement than any static asset. We see the same playbook scaling SaaS companies: they use video to shorten the path from interest to trust.

Trend #5: Trust Signals Are Becoming Non-Negotiable

The flood of AI-generated content has made buyers more skeptical than ever. According to recent B2B surveys, only 21% of decision-makers fully trust vendor content without third-party validation or real customer voices.

Founders often ask: How do we build trust at scale without slowing growth?

Three things matter most:

- Customer proof points: Case studies, testimonials, and authentic customer interviews outperform generic claims.

- Data transparency: Sharing benchmarks, performance metrics, and methodology builds authority.

- Voice consistency: Buyers recognize when thought leadership is human-led versus marketing-speak.

At SEG, our most shared content pairs real founder stories with proprietary data from our deal work. The combination of human perspective and hard numbers cuts through the noise.

SaaS companies doing this well treat trust like a conversion metric. It shows up in pipeline velocity, win rates, and investor diligence conversations.

Trend #6: Marketing Metrics Are Now a Valuation Signal

During due diligence, investors no longer stop at revenue and retention metrics. They dig into marketing performance because it signals how repeatable and scalable growth really is.

We see investors ask for:

- Organic vs. paid pipeline mix to gauge market demand vs. spend-driven growth.

- Customer acquisition efficiency (CAC payback, LTV:CAC) as a proxy for go-to-market maturity.

- Brand visibility and thought leadership to understand competitive positioning.

For founders, this means marketing isn’t just about the pipeline. Companies with predictable, efficient, and well-documented marketing engines command higher valuations because they de-risk future growth for buyers and investors.

At SEG, we’ve seen SaaS companies with disciplined marketing functions outperform peers in exit multiples, even when top-line growth was similar. Marketing strength has become part of the investment thesis itself.

Connecting the Dots Across All Six Trends

Individually, each trend reshapes one part of SaaS marketing. Together, they signal a bigger shift: modern marketing is about proving market demand, building trust at scale, and signaling enterprise value to investors.

This means the marketing function is evolving into:

- A growth accelerator that uses AI, interactivity, and data to educate and convert buyers faster.

- A trust builder where authenticity and thought leadership differentiate you from AI-generated noise.

- A valuation driver where predictable, scalable marketing engines influence how investors perceive risk, growth potential, and competitive positioning.

The companies getting this right aren’t just keeping up with digital trends. They’re creating marketing systems that compound over time, attracting buyers, informing investors, and strengthening exit outcomes in ways disconnected tactics never could.