What is Rollover Equity & How Does it Benefit SaaS Operators

The software world is replete with stories of entrepreneurs who sold their companies and walked away with a massive cash payout. And while that is certainly still an attractive possibility, there may be an even more lucrative deal awaiting those willing to put some of the proceeds on hold. This concept is called rollover equity and is common for private equity transactions.

An increasing number of today’s software M&A deals are structured for sellers with the option to exchange cash at close for a possible upside down the line. Many sellers are looking to invest portions of the transaction proceeds in various investments and find the prospect of tax-deferred investment in a business they know well to be an attractive option.

What is Rollover Equity?

The offer of ongoing ownership is known as “rollover equity” because the seller chooses to roll a portion of the sale proceeds back into the company’s new ownership structure. As an advisory firm specializing in software M&A, we at Software Equity Group have seen this deal structure become more attractive for many sellers as they look for additional upside and hear stories of their peers who benefited from a similar strategy.

These types of deals have become common, particularly when the buyer is a private equity firm. While taking equity in any business comes with a risk, a rollover equity offer can present a significant upside for the seller. Still, it also makes the deal more complicated, so sellers should engage experienced partners to carefully examine the opportunities and risks. Over the past decade at Software Equity Group, we’ve seen some of our former clients have tremendous success when taking a “second bite of the apple.”

If you’re considering selling your software business, it may be wise to consider rollover as part of your deal structure and how it might work to your advantage.

How Does Rollover Equity Work?

We’ve touched on the fact that rollover equity gives you, the seller, an ongoing ownership stake in the company you’ve just sold. To more clearly illustrate how does rollover rollover equity work and why you might find it appealing, let’s compare two hypothetical acquisition offers from two different private equity firms. For the sake of simplicity, this example assumes you own 100% of the company’s equity, have an aggregate $5M of bank debt and transaction expenses, and both offers assume $20M is financed by the buyer through debt.

Firm A submits an all-cash offer to buy your company outright for $100M. You would make $95M after paying off the company’s debt and transaction expenses.

Firm B also offers $100M but encourages you to contribute $20M in rollover equity for a 25% stake in the new company (again, for simplicity, this assumes the rollover equity is issued in the same security that the buyer holds). In other words, you would receive $75M in cash today after paying off the company debt and transaction expenses of $5M and rolling over $20M in the new company. The goal is to see the $20M equity investment grow over time.

| 1st Sale | Terms | Purchase Price | Rollover Equity | Stake | Today’s Proceeds |

| Firm A | All Cash | $100M | – | – | $95M |

| Firm B | Cash & Equity | $100M | $20M | 25% | $75M |

Now, let’s assume you choose to accept the rollover equity offer from Firm B. Over the next three years, the private equity firm does a good job of growing the company’s valuation, and they can sell the company to a new buyer for $400M net of transactions expenses. Let’s assume the new company paid off the $20M of debt during the three-year hold. Assuming you have maintained your ownership percentage from the time of your original deal, you own 25% of the company’s equity.

Wait, 25%? Yes!

Remember, the buyer paid $100M, which comprised $80M of equity and $20M of debt. Your ownership piece of the equity is $20M/$80M, which means you own 25% of the equity or $100M of the $400M. Your total proceeds from the deal with Firm B over time amount to $175M, compared to the one-time $95M received from Firm A. With Firm B, the seller’s cash-on-cash return on the dollars rolled is 5x.

| 2nd Sale | New Purchase Price | Stake | Proceeds from New Sale | Total Proceeds |

| Firm A | – | – | – | $95M |

| Firm B | $400M | 25% | $100M | $175M |

As mentioned above, this example provides a simplified view of rollover equity. Still, there are many, many nuances, and it is important to engage with the right experienced partners to help you understand the terms being offered and how your stock will be treated when the time comes to sell your shares: is there a defined timeline where the seller is not allowed to sell their equity? Are there any put/call rights? Additionally, the seller should confirm their rollover equity is treated as tax-deferred, so they are not taxed for both the cash they collect and the equity they roll over at the time they sell their company.

Rollover Equity Benefits for Software Sellers

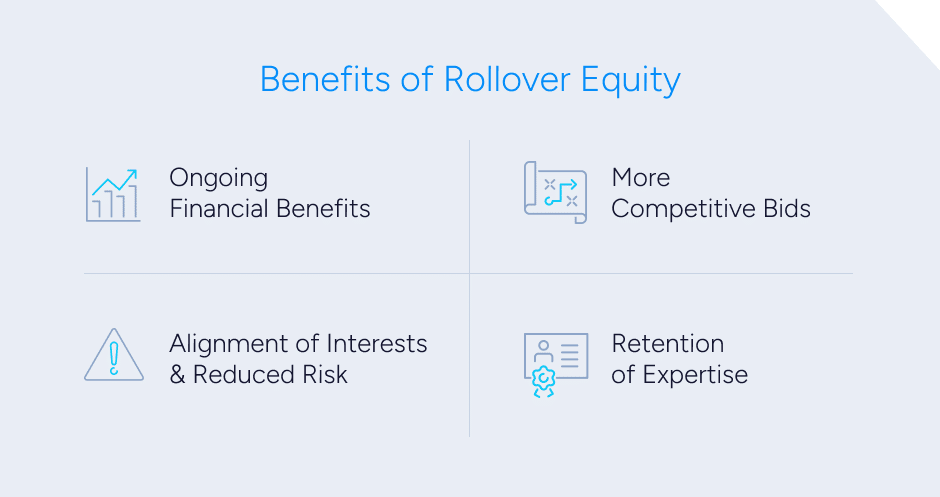

While the numbers involved in real-life M&A transactions tend to be more complex, the example above provides a simplified view of the upside to rollover equity. There are benefits for the buyer and the seller alike:

1. Ongoing financial benefits. The primary benefit for you as the seller is the opportunity to make more money from the sale. Though you will pocket a reduced (but still substantial) cash payment up-front, you retain a stake in the company that will continue to grow in value. Keep in mind most private equity firms will acquire your business with a pre-planned exit strategy. That is, they will take steps to maximize the value of the company and, much like flipping a house, will turn around and sell it for a profit. When that happens, you receive a second payout for the percentage of the entity you still own. If all goes according to plan, you’ll make more (perhaps much more) than you would have received from an all-cash buyer.

2. More competitive bids. As a seller, it will help you understand why buyers might choose to offer rollover equity instead of all cash. One reason could be structuring a deal with rollover equity helps them put together a more competitive bid for your company. They may recognize the company’s value, but they may not have the liquid resources on hand to make an all-cash deal at that time; offering equity instead helps them close the gap and stay in the conversation. This can benefit you as the seller because it brings more bidders to the table.

3. Alignment of interests and reduced risk. From the buyer’s point of view, keeping you on as a minority shareholder incentivizes you to stay engaged in the company and align your interests with its success. For them, it also reduces the risk that you and/or your co-owners may engage in other business activities that could conflict with the goals of your original company.

4. Retention of expertise. In most cases, private equity firms are not looking to acquire a company’s assets and break ties with the seller altogether; they typically value your insights and expertise as the founder and/or CEO. The buyer may offer you a seat on the board of directors or ask you to serve as an ongoing advisor. For you, it’s a chance to keep contributing (perhaps from a distance) and might help increase the value of your equity.

Rollover Equity Questions Software Sellers Should Ask

Deciding between an all-cash offer or one including rollover equity (or even multiple options with rollover equity components) is no simple matter. Like many financial arrangements, the devil is in the details. It is critical to conduct proper due diligence to understand what each offer means to you.

Equity Rollover Questions to Ask

- What percentage of the new company does my rollover equity equate to

- What rights and obligations will I have as an owner in the new company, and how will these compare to my current rights and obligations?

- What is the overall strategy for the new company, and how will it be executed to achieve growth and success?

- What role will I play in the new company, if any, and how will my expertise and experience be leveraged to help drive growth and success?

Equity Rollover Questions to Ask Your Advisor

- What are the potential risks and benefits of rollover equity, and how do these compare to the risks and benefits of a cash-only transaction?

- What are the tax implications of rollover equity, and how will they affect my overall financial position?

- What protections will be implemented to ensure that my equity stake is not diluted or otherwise negatively impacted by future transactions or events?

Partner With an M&A Advisor to Determine Deal Options

When the time comes to sell your company, don’t make potentially profound financial decisions based on gut instinct alone. With more than 30 years of experience in software M&A, Software Equity Group can help you identify and negotiate the best deal possible. With careful analysis to ensure favorable terms, you may find a deal with rollover equity offers an ideal combination of a windfall today and the potential for substantially greater wealth down the road.

This article is provided to you for informational purposes only. Nothing on this article constitutes or is intended to constitute investment, legal, accounting or tax advice, or a representation that any investment or strategy is appropriate to you or your company.