Why PE Investors Love Software Companies

When it comes to investing in 2022, few areas are more compelling than software. Private Equity (PE) firms want to invest in something secure and stable, where cash flow is consistent –something that, for many other industries, remains difficult to project nearly two years into a global pandemic.

Whereas other business models have been greatly impacted by supply chain problems and other COVID-19 woes, software companies have managed to weather the storm, providing stability in a global market with little assurances. Perhaps that’s why 2021 was a massive year for funding among software companies and for PE funding in general. Indeed, “massive” might be an understatement—PE deal value totaled $1.2 trillion in 2021, with $167.1 billion of that going toward merely 947 software deals.

Early forecasts show that 2022 has no signs of slowing down in PE interest; investing in software has never been more popular. SEG’s experts break down why software companies are so popular with investors, how software investment performed last year, key trends going into 2022, and what software business owners should ask themselves in the face of potential investment offers.

- Private Equity Firms Love the Software Business Model

- Predictable Revenue

- Capital Efficiency

- Measurable Success

- Scalability

- 2021 Software Investment Trends Continuing in 2022

- PE funding in 2022 will stay focused on software:

- Potential roadblocks to software PE investment:

- Some sectors will continue to grow massively next year:

- 5 Questions Software Founders Should Ask When Approached for PE Investment

Private Equity Firms Love the Software Business Model

It’s no secret PE funding comes down to one thing: ARR. Luckily for software entrepreneurs and PE firms, software companies use a business model that offers quick, scalable, and repeatable growth and provides investors with more predictable ARR than many other industries.

Buying and investing in software typically appeals to potential investors for four reasons: predictable revenue, capital efficiency, measurable success, and scalability.

Predictable Revenue

If there’s one thing PE firms love, it’s recurring revenue. Luckily for them, software entrepreneurs and founders have by and large found the market’s best solution: a subscription-based product where much of the cost of growth is adding more users. Growth potential is especially attractive to PE firms, given that many software startups can take on as many subscribers as they want while experiencing limited increases in fixed costs.

Compared to the traditional selling model of one-time purchases, the annual subscription model gives investors more insight into future revenue. Stable MRR (monthly recurring revenue) is a great indicator of success, and a key metric investors vet for. Software companies often outshine startups from other industries when it comes to churn and continued revenue growth.

Additionally, software companies can upsell their existing customers with relative ease. Whitespace potential, alongside predictable revenue streams, is a crucial reason private equity firms invest in software.

Capital Efficiency

Not only do software companies provide predictable revenue, but they are efficient uses of capital. For example, compared to other startups, software companies have been proven to generate a higher quality of revenue than other business models, which can be measured with various calculations of unit economics.

Because software companies are so stable, this instills even more confidence for private equity investors and helps them know their investments are worth it in the long run (as the company will provide continued growth as time goes on). Stretching each dollar and providing high returns on that dollar is very attractive to private equity investors.

Measurable Success

Another area where software businesses stand apart is the wealth of metrics they provide about revenue performance and success. Investors love the fact they can track software company performance in real-time. It’s easier to quantify value and identify when change is needed when key metrics are quickly identifiable and measurable.

Scalability

Another aspect that is endlessly appealing to investors about the software business model is how easy it is to scale compared to other industries. Software companies don’t require many of the overhead costs of other businesses, and scaling globally can be as easy as finding new customers in the region.

Physical barriers like infrastructure don’t exist in the same way they do in the software world, where scaling is often a matter of adding additional server capacity. This advantage attracts PE firms because if software companies build the right foundation, the world truly is their oyster. Simply put, software companies are ready-made to scale.

2021 Software Investment Trends Continuing in 2022

Private equity companies came “roaring back” into the world of tech investment in 2021. While 2021 was always expected to be a bit of a bounce-back year after 2020’s understandable slowdown, 2021 exceeded expectations by a wide margin.

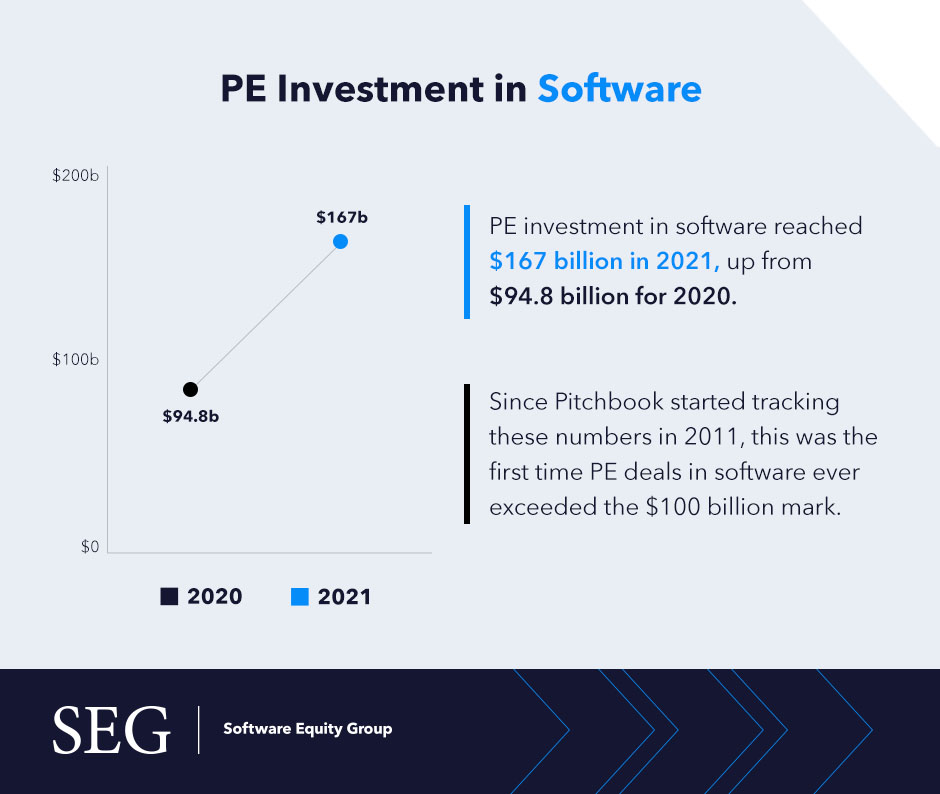

According to Pitchbook’s annual PE breakdown, PE investment in software reached $167 billion in 2021, up from $94.8 billion in 2020. Since Pitchbook started tracking these numbers in 2011, this was the first time PE deals in software ever exceeded the $100 billion mark.

“With more organizations than ever relying on technology, PE firms have been aggressive in finding opportunities as the sector experiences tremendous growth and expansion,” Pitchbook reported.

The question now remains: Does 2021 represent an outlier year for investment in software or portend years of good fortune to come? The latter seems more likely.

PE funding in 2022 will stay focused on software:

This year has already gotten off to a great start for software investment. Additionally, software seems like one of the few areas where investors can feel confident generating an attractive return on investment. The government has pumped cash into the economy in recent years, much of which has found its way into the hands of investors and on the balance sheets of businesses large and small.

If the past few years taught us anything, it’s that businesses will continue to increase their reliance on software to operate and grow, which in turn will increase demand for software products and drive investors to want to support the growth of software providers.

This all leaves software companies uniquely positioned to grab and hold the attention of investors. “With added capital availability, either the prices of software products will come down, or valuations will go up. The latter seems more likely,” says Equidam founder and CEO Daniel Faloppa in an analysis of the software startup fundraising.

Potential roadblocks to software PE investment:

Despite unprecedented figures from last year, that doesn’t mean the software world hasn’t met any roadblocks to PE investment. Indeed, increased regulatory scrutiny and potential government intervention in mega deals have affected the sector in myriad ways.

For example, in early 2021, Visa’s $5.3 billion merger with fintech startup Plaid was abandoned after a DOJ challenge. Similarly, in October of 2021, the FTC announced restrictions requiring buyers to obtain approval before potential monopolistic acquisitions after a proposed $40 billion merger between Nvidia and Arm.

“The policy can significantly delay or derail deals for tech buyers attempting to acquire multiple targets in a similar market,” Pitchbook reported.

And that’s not even diving into Europe’s increased scrutiny over consumer privacy or China’s ever-increasing tech crackdowns. These new regulatory measures—in the US and globally—will likely continue to affect the software sector in 2022.

Some sectors will continue to grow massively next year:

Pitchbook’s annual report highlights several software sectors that will continue to thrive in 2022’s new normal, meeting new needs that sprung up in the challenges following a continuing global pandemic and remote work.

Among many others, software sectors that are likely to continue thriving due to current conditions are:

- Workplace management software

- Real estate/facilities management software

- Supply chain technology

2021 was a massive year for software investing, and early signs point to much of the same in 2022.

5 Questions Software Founders Should Ask When Approached for PE Investment

With PE investor interest in software more focused than ever, it’s important for software entrepreneurs and founders to play their cards right. Navigating the tricky landscape of multiple offers, negotiation, diligence, etc., will play a huge part in the outcome.

Here are five questions to ask yourself if presented with private equity investment offers to help you decide the best course of action moving forward:

- Am I receiving fair market value for my business?

- What other strategic options and/or parties should I be considering?

- How likely is the current offer to hold up through diligence?

- What are the risks and rewards of the current timing? Is now the best time to go forward?

- What kind of partner will the PE firm be, now and in the future?

As we’ve outlined above, the world of software has never been more exciting. The business model is attractive to PE firms, last year hitting record-shattering highs, and this year is poised to remain strong. With all the excitement, you must prioritize the needs of your business by going about any private equity investment in a way that maximizes the outcome for your company, shareholders, employees, and customers.

SEG has over 30 years of experience helping software companies navigate the complex world of PE funding. We offer M&A strategy, majority recapitalizations, divestitures, and board advisory services. Contact us if you’d like to learn more about how we help software companies poise themselves in 2022.