Whether you are looking for a majority recap or strategic sale, have a buyer and just need help uncovering hidden value and navigating potential pitfalls, or just want insights on how to grow and scale your software business, we’re here to help.

SEG Research & Insights

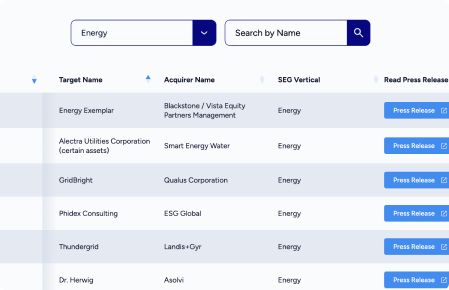

Search Results:

Legal Considerations for Successful Exit Planning

For software company founders, exit planning is among the most intensive and stressful situations they may ever face. However, it can also be one of the most rewarding. Software executives may maintain their current role with their company post-sale or even take on additional responsibilities at the acquiring company or its board of directors. However,… ...

Quality of Earnings (QoE) for B2B Software Companies: A CEO’s Guide

You are at the helm of a dynamic business as a software CEO. As a result, you need the right tools to make strategic decisions with clarity and confidence, and a Quality of Earnings (Q of E or QoE) report can be one of them. A QoE report can not only help you evaluate the… ...

How to Know When It’s Time to Sell Your SaaS Business

Deciding when to sell your business or seek a major investment is a life-changing decision. After devoting your hard work and time to developing said business, you deserve to reap the maximum rewards. Just like timing is crucial for your clients when deciding to buy your software, it’s equally important for your software company when… ...

Understanding the Rule of 40: A Key Metric for SaaS Success

The “Rule of 40” in SaaS valuations is a rule of thumb used to assess a company’s financial health and growth potential. It suggests that the sum of a company’s top line year over year growth rate (annual recurring revenue growth percentage) and its EBITDA margin should ideally be at least 40%. This rule helps… ...

Can You Sell Your SaaS Company on Your Own? Tips from a Founder

As a software or SaaS founder, you are likely aware that merging with or being acquired by another company could offer an attractive exit opportunity for you, your shareholders, and your company. I sold my first company without an advisor and was at a disadvantage from the get-go. Aside from not having the opportunity to… ...