Today’s SaaS M&A Market: Outlook from 25 Strategic Buyers

We Asked, They Answered. What 25 Strategic Buyers Have to Say About the Current M&A Market.

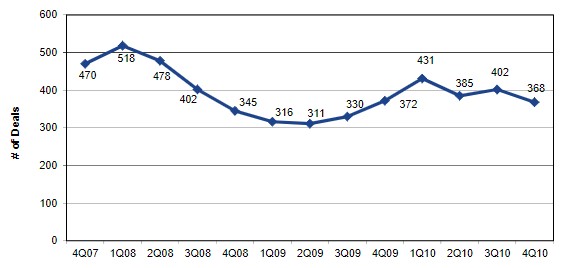

The Bull M&A market has surged for the past decade, far longer than any previous period. During this time, annual SaaS M&A activity has consistently grown year-over-year. How will SaaS M&A fare in 2020? Does looking back at the 2008 Global Financial Crisis offer any guidance? During the GFC, software M&A activity fell 40% percent from peak to trough. However, SaaS business were just beginning to change the software landscape and comprised a tiny portion of total M&A activity. The vast majority of deals were perpetual license model software businesses.

Quarterly U.S. Software Sector M&A Activity

Today, the industry has shifted to subscription pricing models with an extreme focus on protecting and building annuity streams. It is not uncommon for these recurring annuity streams to account for more than 70% of a SaaS company’s revenue. In contrast, the recurring maintenance and support (M&S) annuity stream of a perpetual license-based business would often account for approximately 30% of total revenue. Thus, M&A execution risk has been materially reduced, especially when combined with strong retention rates.

Software has also disrupted traditional business operation methods; many corporations now rely heavily on software to operate and numerous non-software companies have acquired software/expertise to remain competitive.

2020 will be an interesting case study to ascertain the strength of strategic buyer activity through recessionary times. While it’s likely to have a negative impact on valuations and overall activity, the world’s reliance on software is stronger than ever and likely to accelerate over time. Will strategic buyers be sitting on the sidelines in the event of an extended downturn similar to the GFC, or will the underlying drivers and health of the industry buy deal volume? We held conversations with 25 strategic buyers to assess how they are approaching M&A in the current market. We hope you will find their answers insightful.

How is the current market impacting your M&A initiatives today? How about down the road?

- Many strategic buyers are in a very strong cash position. They view this as an opportune time to acquire attractive assets at reasonable prices. Many are keeping an open, optimistic, and acquisitive mindset, though there is likely to be a heightened focus on profitability / cash flow as a material value driver. Buyers also appear ready to forego larger transactions and focus on less-risky smaller deals to plug product gaps during these uncertain times (see post: What SaaS CEOs Need to Know About Strategic M&A During COVID-19).

- Given the broad shock to the economy, priorities for many strategic buyers have shifted. Many are focusing on internal operations: ensuring near-term BCP measures are successfully implemented prior, focusing on customer retention, and attempting to understand how their 2020 projections are affected.

What about the broader M&A landscape and deal activity for 2020?

- Many buyers tend to believe the M&A market will naturally slow, as many wait for the broader markets to stabilize. With a lack of accurate forecasts for both strategic buyers and potential M&A targets, a number of strategic buyers would like to see actual results for Q1 and Q2 prior to moving forward with deal making. Until some sense of normalcy returns, we’re likely to see high caution amongst strategic buyers.

- Contrarily, some strategic buyers are beefing up their M&A resources to take advantage of this crisis as much as possible. For years, asset prices have been inflated. Many see this as an opportunity to make strategic investments at more modest prices. Many also believe they are likely to turn to inorganic growth to supplement meager organic growth during a recessionary period (a driver we’ve not experienced the past decade). Some acquisitions yielding tremendous long-term value came through opportunistic deal making during the GFC. Many appear to be gearing up to execute on this playbook.

If you were working in M&A in the 2000s, how similar or different do you view this current market impact vs the global financial crisis in 2008/2009?

- The general timeline of how long the recession was likely to last in 2008/2009 was much clearer. There was a general plan of actions being executed in order to tackle defined problems within the financial markets. The current picture of what lies ahead is murkier and there is no certainty around how long this will last. During the GFC, normal business operations continued and SMB’s weren’t nearly as impacted. A domino effect appears to be at play, with skyrocketing unemployment, businesses closures, and a lot of unknown.

- There are a few silver linings…the health of the software industry is very strong and a large private equity backstop remains (see post: What’s Happening in Today’s Private Capital Market?). Businesses have come to rely on their software vendors more than software vendors rely on their customers. How many industries can make that claim? Additionally, private equity firms are sitting on record amounts of capital and increasingly see B2B SaaS as the best asset class for risk adjusted returns.

How do you think this impacts valuation in 2020? How about in 2021?

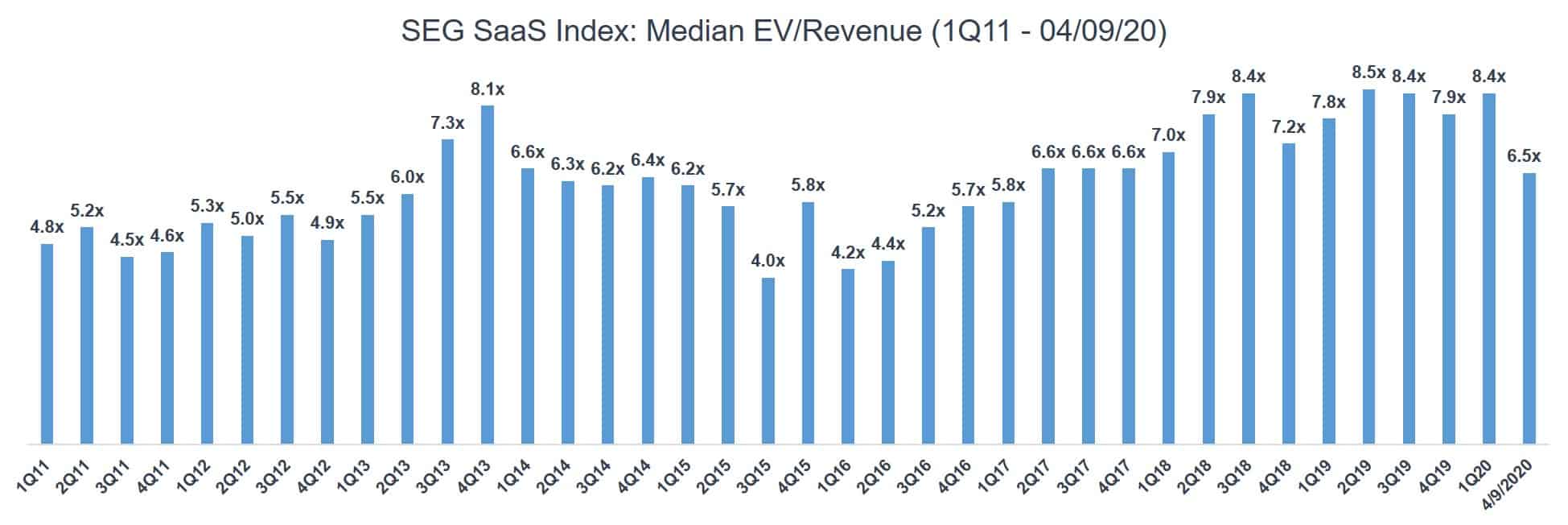

- Most buyers are under the impression valuations will fall. They are pointing to recent public market declines and volatility as arguments for reduced bids in private M&A transactions. This said, the SaaS public market valuations have fared quite well (see post: COVID-19 Impact on SaaS Valuations). M&A valuations typically lag public market valuations by three to six months, as deals that were already negotiated tend to close or evaporate altogether. There is a general consensus of uncertainty surrounding impacts to value over the next two years, though most believe any impact is likely to be negative. With that said, many acknowledge certain recession resistant verticals may see minimal negative valuation impact while other verticals are likely to be hard hit.

What types of businesses become more or less attractive in the current market?

- The common consensus is to avoid software companies providing solutions to service-based / face-to-face businesses. These businesses have been most negatively impacted. There is real uncertainty when these businesses will come back online and what those businesses will look like long-term.

- A number of verticals are likely to fair quite well during any extended downturn, sequentially experiencing continued acquisition demand and buoyed valuations. Strategic buyers listed education, healthcare, government, and pharmaceutical verticals as less risky markets. No surprise, they also listed products enabling distance learning, remote collaboration, ecommerce, and security as likely to be in heightened demand for the foreseeable future. Those businesses demonstrating strong unit economics, retention, and high amounts of recurring revenue are likely to be in heightened demand as well.

How does this new way of working structurally change the work environment, if at all?

- There will be a significant learning curve as many employees adjust to working virtually for the first time. Companies with a pre-existing distributed workforce will have a smoother transition into remote work, along with those already incorporating remote work as part of their routine. The largest issue facing M&A is buyers won’t have the ability to meet sellers to do deals, although many businesses are finding alternative ways to make deals happen.

- There may be long-term changes in the workplace following the crisis, with roles shifting from the office to the home. A key concern is real estate is likely to be negatively impacted, as companies learn they can successfully conduct business with comparably cheaper collaboration technology, rather than entering into commercial real estate leases.

Please reach out if you’d like to discuss how current events may impact your software company’s near and long-term plans.