Whether you are looking for a majority recap or strategic sale, have a buyer and just need help uncovering hidden value and navigating potential pitfalls, or just want insights on how to grow and scale your software business, we’re here to help.

SEG Research & Insights

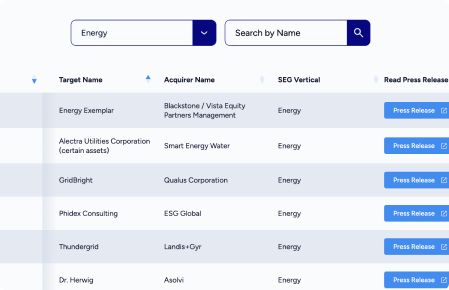

Search Results:

The Pulse of Education SaaS

Gain insights into the Education Software sector, including industry headwinds and tailwinds, digital transformation trends, the P-F curve, the software vendor landscape, recent M&A activity, and more.

Accurately Calculating EBITDA for Software Companies

Now more than ever, private equity firms and strategic buyers prioritize profitability when analyzing potential acquisition targets. They want to know that your company can make money, operate efficiently, and make smart spending decisions to maximize financial gain. To get a sense of your company’s profitability, the most common metric buyers examine is known as… ...

How to Future-Proof Your Software Platform for Acquisition or Growth

Watch this SEG webinar in partnership with KMS Technologies to explore how to build innovative solutions that drive growth and enhance acquisition potential.

SaaS Market Update Highlights

SEG Analyst, Gabrielle Avantino, shares an overview of SEG's Quarterly SaaS Report. Tailored for SaaS founders and executives, our latest research provides the insights necessary for making informed decisions in strategic growth or exit planning.

Education Software in Today’s Schools: Sector Trends and M&A Insights

Like many other facets of society, the Education Software sector is undergoing significant transformation driven by the digital revolution. Over the last two decades, America’s school systems have aggressively pursued technological solutions to help improve the quality of educational programming, expand access to underserved communities, and streamline administrative processes. The COVID-19 pandemic accelerated the trend,… ...

How to Optimize Your Company’s LTV to CAC Ratio

Running a thriving software business requires, among other things, two foundational capabilities. First, you must find ways to acquire new customers without overspending on sales and marketing. Second, you need those customers to stick around and provide recurring revenue to your company, ideally for years. If you can succeed in these two areas, your SaaS… ...

Why is Net Working Capital Important in M&A?

If you’re selling your software business, it’s essential to understand key financial variables that may impact the process. One such metric is net working capital (NWC). However, when it comes to mergers and acquisitions, calculating NWC and determining a normalized level for the business can be much more nuanced than it appears on the surface. … ...

Legal Considerations for Successful Exit Planning

For software company founders, exit planning is among the most intensive and stressful situations they may ever face. However, it can also be one of the most rewarding. Software executives may maintain their current role with their company post-sale or even take on additional responsibilities at the acquiring company or its board of directors. However,… ...

Expertise That Elevates Every Endeavor

It’s time to talk about your company’s future.

Fill out the form and we’ll discuss…

- Multiples and interest

- Buyer dynamics and priorities

- Valuation insights