The State of Government SaaS M&A: Trends Driving Growth and Deal Activity in 2024

Since the turn of the century, digital transformation has swept through the private sector. Companies in every industry have seized upon software and other technologies to help them work faster and smarter.

Meanwhile, government agencies have recognized the need for change, but (not known for their business agility) most have been slower to turn the ship. Today, digital transformation continues to accelerate as the public sector works to make up for lost time. Public demand and increasing complexity in government operations drive agencies to invest heavily in digital products and services, including software. At the local, state, and federal levels, government bodies are eager to adopt SaaS solutions that help them streamline bureaucratic processes, achieve new capabilities, and overcome labor shortages.

This growth trend, spurred by various catalysts, creates significant opportunities for Government Technology businesses of every size and specialization. In turn, it has led to a surge of mergers and acquisitions in the Government software space, particularly for SaaS businesses.

As an M&A advisor, Software Equity Group keeps a close eye on this space, and we’ve been deeply engaged in our own right, advising on more than 20 Government transactions for our clients in recent years. In this post, we’ll look at the trends driving SaaS adoption throughout the government sector and the opportunities and challenges that SaaS entrepreneurs face as they shape their exit strategies.

What’s Driving SaaS Adoption in the Government Sector?

In 2023, Government was the fifth most active vertical for SaaS M&A activity, with roughly 50 transactions accounting for 6% of all SaaS M&A deals (an increase from 5% in 2022). And, so far, we’re aware of 11 transactions in the first quarter of 2024.

It’s clear that growth in the Government space, and thus the proliferation of Government SaaS M&A deals, stems from the public sector’s growing urgency to accelerate digital transformation. But there is more to the story. Digging deeper reveals some underlying trends that SaaS businesses and their potential buyers would do well to understand.

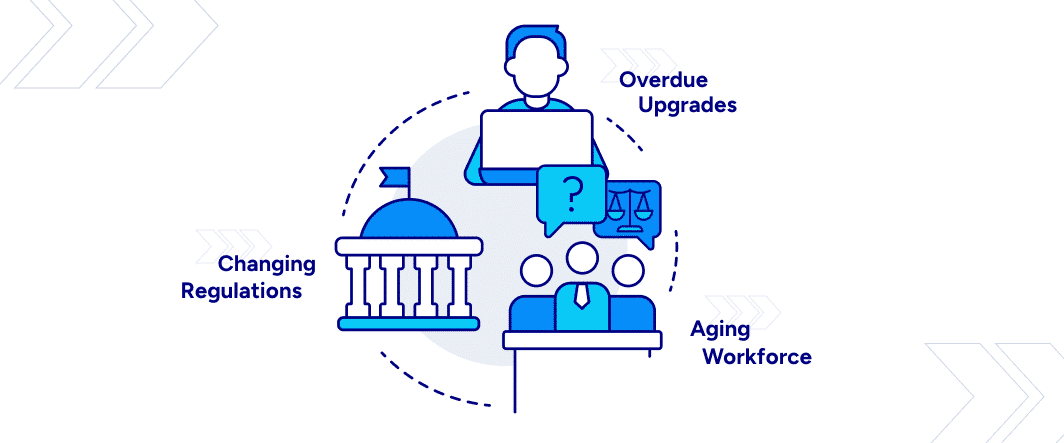

- Upgrades are overdue and imperative. It may come as no surprise that the public sector (with the exception of the military) typically lags behind corporate America regarding technology. This is especially true of large, sprawling institutions established many years ago, whose operations depend on manual processes and are entrenched in legacy computer systems. Further hampered by regulations and the infamous red tape of the Government, implementing any significant change in this environment can require years of planning and transition. Nevertheless, leaders in the public sector recognize the need to keep pace with a rapidly evolving digital society, lest they be ineffectual. And they need software companies to help them get up to speed as quickly and painlessly as possible.

- An aging workforce creates labor challenges. Finding enough workers to perform all its manual tasks has become a severe problem for the public sector. Baby Boomers, the youngest of whom are now 60, are retiring in mass, taking decades of institutional knowledge with them and leaving many important roles vacant. To continue meeting their ever-increasing obligations, government agencies know that digital transformation is the answer, using software to perform hyper-specific tasks and doing more work with fewer people. At the same time, as the government works to counteract the “Silver Tsunami” and fill job vacancies, they will need to showcase more modern internal solutions that appeal to younger workers have come to expect.

- Changing regulations makes things even harder. By their very nature, government agencies are highly regulated organizations. And the job of staying in compliance with complex and shifting regulations becomes more difficult every year, as nearly every agency faces heavier demands with fewer workers to meet them. For example, government entities are trusted with securing a mind-boggling amount of sensitive information, from medical records and social security numbers to law enforcement files and critical infrastructure plans. Thus, they must maintain the most robust security standards without grinding operations to a halt. At the same time, the Freedom of Information Act and other legal developments grant Americans unprecedented access to the inner workings of Government. This makes it paramount that public sector organizations maintain meticulous records of processes, authorizations, and transactions, staying ready to serve taxpayers on demand and defend the agency’s actions should they come into question.

- Agencies strive for citizen engagement. At all levels of government, agencies are eager to get the public more involved. Whether it’s fostering support for civic programs, educating citizens about important changes in legislation, or driving higher voter turnout, government organizations are turning to software to better connect with their constituents. Digital, mobile solutions are making it easier for people from all walks of life to access public information and services, and perform everyday tasks that, put together, contribute to a higher-functioning society.

To meet these needs and rise to other challenges, government agencies need the help of high-powered yet intuitive software.

Big Opportunities for SaaS Founders in Government SaaS M&A

As the challenges facing the government sector mount, the market for government-focused SaaS solutions continues to grow. Whether they’re looking to build their business or sell it, SaaS entrepreneurs in this space can take advantage of several promising opportunities:

- Hyper-specialization and consolidation. The size and scope of the U.S. government are vast (not to mention state and local governments), and they conduct an incredible range of activities with highly specialized requirements. SaaS founders are discovering they can build an entire business providing niche software to meet one agency’s unique needs. Private equity firms and larger Government SaaS companies know this as well, and they’re expanding their addressable market by acquiring the expertise they need to dominate in certain spaces. In recent years, several of the leading consolidators have rebranded themselves (for example: Catalis, Euna Solutions, and Central Square) to reflect this approach and continue to buy up niche SaaS providers.

- Excellent customer retention. Winning a government contract may not be easy, but once you’re in, you’re usually in to stay. Due to the typically thorough RFP and vetting process required to win most government contracts, agencies tend to choose vendors and stick with them for a long time. For SaaS businesses, the mission-critical nature of their products creates predictable demand and consistent buying patterns from these customers, resulting in strong recurring revenue. It’s another reason acquirers are moving aggressively in the Government SaaS space.

- The buy vs. build mentality. Strategic buyers in Government are constantly looking to enter new markets, and buying a SaaS business with a solid product is usually easier than building a new capability in-house. They can use their sophisticated sales organization and knowledge of the Government’s complex purchasing processes to win contracts and scale up the acquired SaaS business.

Seek a Balance of Specialization and Versatility

While many SaaS founders are finding success in catering to a particular government niche or even a single agency/customer, there can be downsides to this approach. For example, some SaaS companies win their first big contract with a particular state government, and from that point forward, all their work is dedicated to meeting that state’s specific requirements. While the single-state contract may be large enough to sustain the business indefinitely, customer concentration becomes a problem; it limits the SaaS company’s growth because the software is overly customized and can’t be easily reconfigured to meet different requirements in other states.

Similarly, SaaS companies may have a highly specialized product that does one specific job very well, perhaps for multiple government customers. However, if the company has not broadened or diversified its offering, its total addressable market is limited.

Either of these scenarios—customer concentration or over-specialization—may deter prospective acquirers seeking targets with higher long-term growth potential. SaaS businesses with highly focused offerings should consider broadening their horizons and building more flexibility into their products and plans to improve their chances of being acquired.

A Good Time to be in Government SaaS (And Pursue M&A)

Given the Government’s rapid pursuit of digital transformation, there has never been a better time to be a software firm focused on the Government sector. And that notion is supported by a long and growing list of successful M&A deals, including multiple transactions on which SEG has served as an advisor.

If you have a software business that serves the public sector, don’t let the wave of opportunity pass you by. Contact SEG for seasoned advice on attracting acquisition interest in your company and securing the best possible terms.