- Company

Featured Resource

CLIENT STORYModern Message

To Real Estate

Giant RealPage

- Sectors

Featured Industry Report

EXPERT SERIESManufacturing Software

Report – Part 2

- Research

Featured Resource

FEATURED REPORTThe SEG 2024

Annual SaaS Report

- Tools

Featured Resource

WHITEPAPER20 Factors to Track When Valuing Your

SaaS Company

- Blog

How to Improve the LTV to CAC Ratio

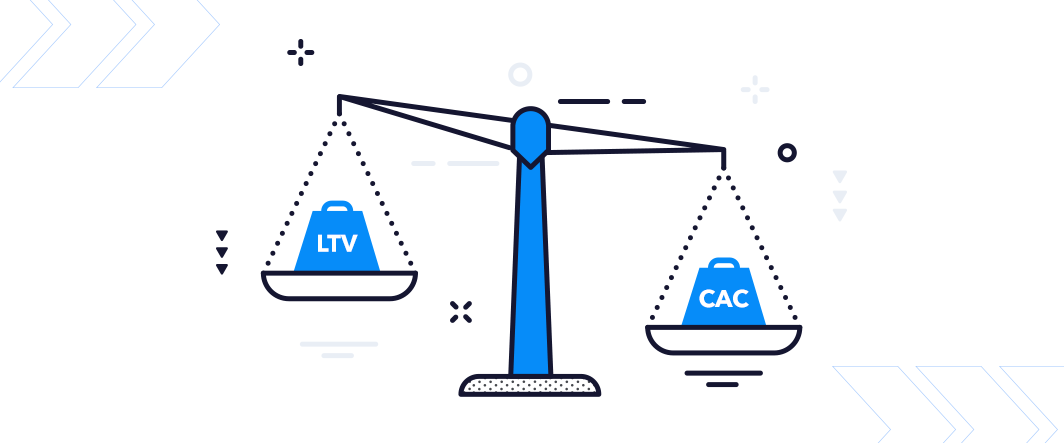

LTV:CAC is considered one of the most critical metrics for valuing SaaS companies. Investors place a high focus on this metric, as it indicates good growth potential with limited marketing investment. Companies with lower LTV:CAC ratios indicate to investors that capital required to acquire new customers may not be utilized efficiently. So it’s natural for SaaS companies in this situation to wonder what they can do to optimize their LTV:CAC ratio and, in turn, attract a higher valuation.

Understanding the LTV to CAC Ratio

Before jumping into optimization strategies, it’s important to intimately understand how the LTV to CAC ratio works. Although we go into more depth on these calculations in a previous blog on the LTV:CAC ratio, we will provide a brief overview here.

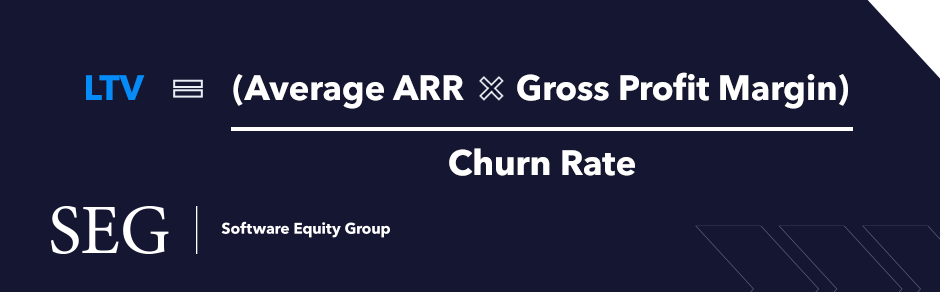

In short, LTV, or lifetime value, refers to the dollar value a single customer can be expected to generate over the duration of their relationship with a company (no matter how long that might be). The LTV:CAC ratio calculation is as follows:

Taking metrics like Average Annual Recurring Revenue (ARR) and Gross Margin and dividing it by your company’s churn rate allows you to get a quick calculation of average LTV. Churn refers to the rate at which customers unsubscribe from or leave your services over a stated period of time. A lower churn typically correlates with a higher LTV since customers are opting to stay longer with a company rather than leave for competitors, thus generating more value for the company.

The other half of the LTV:CAC ratio is, obviously, CAC, or cost of acquisition.

CAC refers to the amount that a company pays to acquire a single new customer via marketing and sales efforts. The lower the CAC, the better your company is balancing costs and benefits in the customer acquisition phase.

Put together, measuring LTV in relation to CAC provides a broad overview of the efficiency of your sales and marketing strategy. A strong LTV to CAC ratio indicates that a company has an effective sales and marketing strategy and signals that the continued investment in the product will likely pay off. This, in turn, means that the business in question likely has good potential for growth even with incremental investments into sales and marketing. In contrast, a low ratio means that the capital required to acquire new customers is not being effectively utilized and that capital may need to be reallocated to improve retention or gross margins. These indicators are why buyers and investors tend to place great weight on the LTV:CAC ratio of potential acquisitions. Having numerical proof that a company is able to win and keep customers – with a long-term success rate – creates confidence for buyers.

Segment Customers to Improve LTV to CAC

So how does your company optimize its LTV:CAC ratio? One way is to place greater emphasis on strategic customer segmentation. Segmenting customers allows businesses to better tailor marketing campaigns toward the prospects most likely to purchase. It also enables companies to identify their highest value customers and thus allocate the proper resources to ensure they are satisfied and successful. For specific strategies on how to improve segmentation, the SVP of Global Sales at Arena Solutions, Andrea Pitts, goes into depth on the subject in one of our “Virtual Coffee” discussions.

A company should evaluate and segment its customer base by industry, product, size, or any other applicable metadata. Companies often find that though some customer segments generate significant revenue, they have a relatively shorter engagement period. Shorter customer tenure indicates lower engagement, resulting in a lower LTV. Andrea describes this circumstance at Arena Solutions: “Very early on, we took a closer look at our customers by evaluating the prior ten quarters of new revenue and where it came from. We were selling to 89 industries. After we segmented our customers, we found that over 90% of our new revenue came from only 14 industries.” (Watch the clip here.)

Additionally, Arena Solution’s higher revenue prospects resulted in the misallocation of sales resources to customer segments with lower retention rates instead of focusing on revenue-generating customer segments with high retention. Segmenting the sales team to sell to specific customer segments with targeted products has proven to be highly effective for companies marketing efforts on high-value customers.

Other Ways to Improve LTV to CAC:

Here are some additional strategies for improving your company’s LTV:CAC ratio.

Knowing Your ICP Can Improve LTV to CAC

Employ a targeted sales approach that uses role- and value-based selling to target your efforts to the relevant areas of value for each individual. What matters to an engineer is not always the same as what matters to a manager. Selling to and addressing the needs of an engineer versus a manager requires a differentiated approach to demonstrate the value of your product.

Andrea suggests, “Instead of understanding what they do in their job, understand what is keeping them from being able to do their job. Make sure you can tie it back to the value you provide.” (Watch Clip).

Reducing Expenses Can Improve LTV to CAC

Reduce sales and marketing expenses through customer segmentation and sales specialization to concentrate efforts on high value customer segments. This will enable your team to develop expertise and propose the best fitting product for potential high retention customers. Use of lower cost mediums or improved efforts at lead generation can also make more effective use of marketing spend.

Eliminate Customer Pain Points and Friction Can Improve LTV to CAC

Shorten the sales and onboarding cycle to improve the number of new customers that make it through the whole journey. Data is essential to this effort. Many organizations track everything. A more productive practice is to focus on key sales metrics and hone in on those. Time-stamping every part of the sales cycle can also provide insights into where there are opportunities for improvement or redesign.

Focusing on improving the customer experience will also reduce churn and improve LTV via higher retention rates. It also leads to increased gross profit margins by decreasing cost and time of implementation. Ultimately, the key is strategic customer segmentation and providing high-touch customer support. Knowing the value of your product and how it fits your customer’s needs is important to this effort.

These few strategies can go a long way in improving your company’s LTV to CAC ratio. With an improved ratio, your company will be on its way to reaching a higher valuation. Furthermore, a healthy LTV:CAC ratio signals to investors that your company has effective marketing and customer profitability. Please reach out should you wish to discuss the best method for optimizing the LTV to CAC ratio for your business in more detail.