- Company

Featured Resource

CLIENT STORYModern Message

To Real Estate

Giant RealPage

- Sectors

Featured Industry Report

EXPERT SERIESManufacturing Software

Report – Part 2

- Research

Featured Resource

FEATURED REPORTThe SEG 2024

Annual SaaS Report

- Tools

Featured Resource

WHITEPAPER20 Factors to Track When Valuing Your

SaaS Company

- Blog

Calculating EBITDA for Software Companies

“How profitable is your software business?” It’s a simple question, but it’s not always easy to answer. Nevertheless, profitability is a critical measure of success that any business owner should understand and be able to communicate. Profitability, aka EBITDA, is even more important if you want to attract new investors or sell your company.

Now more than ever, private equity firms and other buyers prioritize profitability when analyzing potential acquisition targets. They want to know that your company can make money, operate efficiently, and make smart spending decisions to maximize financial gain.

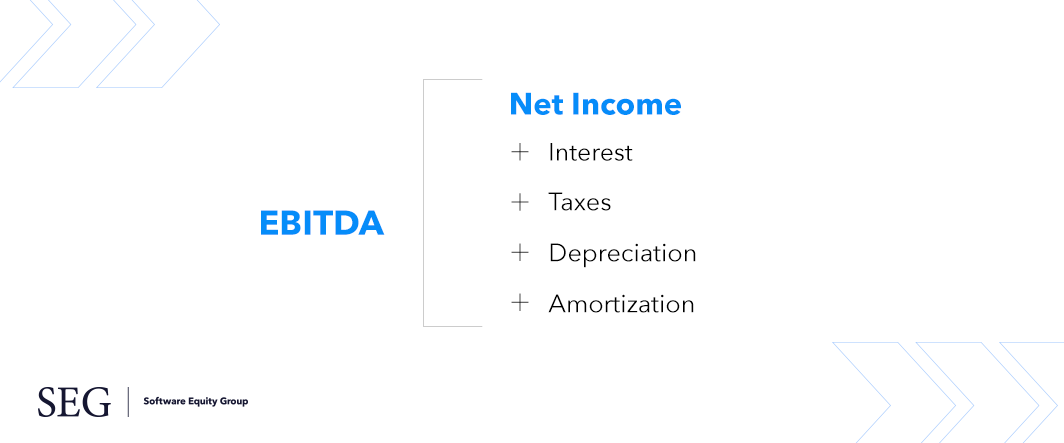

To get a sense of your company’s profitability, the most common metric buyers examine is known as EBITDA. It’s an accounting acronym that means Earnings Before Interest, Taxes, Depreciation, and Amortization (note: It is usually pronounced as a single word – Ee-bit-dah – rather than spelled out as individual letters). This metric is often used in conjunction with revenue, cost of goods sold / gross profit margin (see more about calculating COGS here), and net income to assess a company’s overall financial performance.

The more you learn about EBITDA and the accounting practices behind it, you might find that your company is more profitable than you realized. And that could help you position the company for a more rewarding merger or acquisition.

How to Calculate EBITDA

To calculate EBITDA, simply take the net income of the business and add the following:

- Interest expense

- Taxes

- Depreciation expense

- Amortization expense

This is the basic formula, but there are other variables, known as EBITDA adjustments, that can make things a bit more complicated.

Understanding EBITDA Adjustments (Add-Backs)

One limitation of EBITDA, when taken at face value, is that it may not account for certain one-time, non-recurring expenses. These anomalous expenses are not an accurate representation of the business’ true expense needs, so it makes sense to adjust the metric to get a clearer reflection of expected profitability going forward.

These EBITDA adjustments, commonly called “add-backs,” typically include (but are not limited to) items such as:

- Non-recurring legal expenses

- Non-recurring labor expenses (recruiting, severance)

- One-time project expenses (web redesign, system rewrites)

- Personal/lifestyle expenses incurred by owners/executives

- Above-market compensation for executives (for example, if the market rate for the CEO of a small-to-mid market software firm is $300K per year; any compensation above that would be an add-back)

- Profit-sharing expenses for employees not expected to continue with the business

- Engineering and development expenses on a new product that has generated little-to-no revenue

To arrive at the Adjusted EBITDA, one would simply take the basic EBITDA plus any add-backs. The adjusted number gives potential investors or buyers a normalized metric by which to make more standard valuations across multiple companies. In other words, it helps them compare apples to apples and can potentially make your company look like a more attractive target.

EBITDA Example Calculation

Let’s say the company in question has $5 million in revenue and $5.5 million in total expenses, which equates to a loss of $500,000. However, the company has $500K total in interest expenses, depreciation, and amortization. This balances out to a calculation of $0. The EBITDA margin (EBITDA/revenue) would be 0%, indicating that the business is breaking even.

Upon further examination, the company also had the following non-recurring expenses in the past year:

- $1.5 million in compensation going to three key owner-operators

- $300K recruiting expense to hire a new head of marketing and head of sales

- $50K one-time web redesign expense

If we assume that, in a scenario where the business is acquired, the three key owner-operators will exit and can be replaced at salaries of $250K each, then the metric is adjusted by:

- Adding back $750K of above-market compensation (1.5 million – ($250K x 3))

- Adding back $300K recruiting expense

- Adding back $50K one-time web redesign expense

Total Add-Backs: $1.1 Million

Adjusted EBITDA (EBITDA + Add-Back Amount): $1.1 million

EBITDA Margin (1.1 million / $500K in revenue): 22%

Key takeaway: By carefully analyzing the company’s expenses and adjusting EBITDA with the appropriate add-backs, the company appears much more profitable than its original EBITDA suggested.

Cash-Adjusted EBITDA

Beyond the Adjusted EBITDA, software buyers may also be interested in knowing your company’s Cash-Adjusted EBITDA, which is a different calculation. By accounting for deferred revenue (cash you’ve collected in advance of delivering services), the Cash-Adjusted metric accounts for future changes that are not yet reflected in the original metric. In other words, it provides a preview of EBITDA yet to come.

To arrive at Cash-Adjusted EBITDA, you first need to calculate two other numbers:

- The 12-month trailing EBITDA (the average for the previous 12 months)

- The year-over-year change in deferred revenue (change in deferred revenue from the beginning of a 12-month period to the current month)

The complete formula for Cash-Adjusted EBITDA is as follows:

12-month trailing EBITDA + YoY change in deferred revenue = Cash-Adjusted EBITDA

This calculation is especially pertinent for SaaS companies because they often collect payment in advance for year-long software subscriptions. Assuming current sales are strong for your company, Cash-Adjusted EBITDA may cast you in the best light in the eyes of potential buyers or investors.

How to Improve Your Company’s EBITDA

As we’ve demonstrated, various methods of calculating EBITDA can help you put your company’s best foot forward in hopes of being acquired. But it’s important to recognize that viewing the numbers through these different accounting lenses has no bearing on your company’s actual performance. To truly improve this metric (i.e., profitability) requires making some real-world operational changes to increase revenues ahead of costs or simply decrease costs. Those, of course, are the two most fundamental goals of any business and could be achieved in a myriad of ways. Whether it’s finding ways to accelerate product innovation, drive sales in a new market, or scaling back expenses in non-critical areas of the business, maximizing efficiency across the board is what produces a higher EBITDA and margin percentage.

EBITDA Isn’t Everything

To reiterate, EBITDA is certainly an important metric that strategic buyers and private equity investors use to evaluate a company’s profitability. Higher margins are always a positive in the acquirer’s eyes, but they will look at this number in conjunction with growth to better understand the company’s capital efficiency.

Relatively young companies are less likely to be profitable early on. As they’re pressure-testing their business model, investing in growth, and finding their place in the market, it can take some time for revenue to catch up to expenses. They may have a negative number but still have positive cash flow if they’ve sold year-long subscriptions in advance. For this reason, buyers may also consider Annual Recurring Revenue (ARR) growth as a key factor in valuing SaaS companies.

Also, be sure to read our post on The Rule of 40, another go-to metric among software investors. Essentially, the Rule of 40 states that when a company’s revenue growth rate is added to its profit margin, the total should be greater than 40%. The rule is discussed in more depth in our white paper, “18 Factors You Need to Track When Valuing Your SaaS Company.”

Bottom line: EBITDA is an important profitability metric any business owner needs to understand, and it’s just one of many factors potential buyers will use to determine your company’s valuation.

We Can Help

At SEG, we draw on 30-plus years of experience in M&A advisory services to prepare our clients for a liquidity event now or down the road. If you have any questions about calculating EBITDA and add-backs, please don’t hesitate to contact SEG.