Whether you are looking for a majority recap or strategic sale, have a buyer and just need help uncovering hidden value and navigating potential pitfalls, or just want insights on how to grow and scale your software business, we’re here to help.

SEG Research & Insights

SEG 2024 Annual SaaS Report

The Data Shows SaaS is Here to Stay

In 2023, M&A activity surged, marking the second-highest transaction count, closely following 2022. The SEG SaaS Index™ soared, posting an impressive 34% growth for the year.

Explore What’s Trending

Stay Up-to-Date on the Latest Market Trends

Subscribe to the latest trends that impact the software market and business valuation.

BROWSE CONTENT BY SECTOR

Education

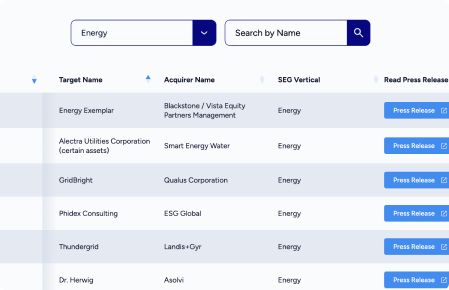

Energy

Government

-

INDUSTRY INSIGHTSLearn about the SaaS Government sector, including latest industry trends and data, all in one place.

-

MARKET MAPSurvey our list of Government SaaS vendors and sector categories on our interactive page.

-

SEG TRANSACTIONSSee all of our closed deals to take a closer look at our track record in the Governement sector.

Healthcare

Manufacturing

-

INDUSTRY INSIGHTSAcquire valuable insights into the Manufacturing sector through our thorough analysis and viewpoints.

-

REPORTExplore our Manufacturing reports, crafted in collaboration with industry expert Paul Lachance.

-

CLIENT VIDEOListen to the personal story of one Manufacturing founder and their M&A exit journey.

Real Estate

-

INDUSTRY INSIGHTSGain valuable insights into the Real Estate sector with our in-depth analysis and expert perspectives.

-

CLIENT VIDEOStep into the shoes of a SaaS Real Estate founder as they share details of their successful exit.

-

CLIENT VIDEOJoin an industry founder on their personal M&A exit story, offering insights into the process.

BROWSE CONTENT BY TOPIC

Finance & Valuation

Insights & Trends

SEG WEBINAR

How Top Performing SaaS Leaders Create Sustainable Avenues to Drive Growth

M&A Process

Strategy & Growth

Expertise That Elevates Every Endeavor

It’s time to talk about your company’s future.

Fill out the form and we’ll discuss…

- Multiples and interest

- Buyer dynamics and priorities

- Valuation insights