- Company

Featured Resource

CLIENT STORYModern Message

To Real Estate

Giant RealPage

- Sectors

Featured Industry Report

EXPERT SERIESManufacturing Software

Report – Part 2

- Research

Featured Resource

FEATURED REPORTThe SEG 2024

Annual SaaS Report

- Tools

Featured Resource

WHITEPAPER20 Factors to Track When Valuing Your

SaaS Company

- Blog

How To Calculate Churn Rate Correctly (With Formulas and Examples)

As a software operator, you know how difficult it is to achieve growth milestones while losing revenue from existing customers. Customer churn puts a strain on the sales team to outperform so that the company can maintain growth. This is why it is crucial for operators to closely track and analyze various churn metrics in the customer base.

Understanding and managing different types of churn affects your bottom line and your ability to attract quality investors and buyers. If you’re only looking at one churn rate, like logo churn, but ignoring net dollar churn, you could be missing out on important insights.

Discover which churn metrics are crucial to ensure the health of your customer base and how to calculate each metric. You’ll gain insights into how to interpret different types of churn and what these metrics mean for operating your business.

What is Churn?

In the broadest sense of the term, churn is a measurement of the subscribers, clients, accounts, or customers a company loses over a period of time. For software businesses, churn generally refers to when subscriptions are canceled or decreased (in dollars spent). This metric is often expressed as a percentage rate – for example, a monthly churn rate of 5%. It can also be indicated by whole numbers, such as a report listing a churn of 250 subscribers or a revenue churn of $10,000.

The software industry uses several types of churn to evaluate businesses, including customer or logo, lost dollar, gross dollar, and net dollar churn. But more on this later.

What is a Churn Rate?

Churn rates measure customer growth and turnover, giving you critical insights into your company’s customer base, financial performance, strengths, and areas of opportunities. Software companies use churn to determine where to focus on in the existing customer base both from a customer support and success perspective as well as a sales and marketing perspective. This metric is also included as part of the calculation of customer lifetime value, an important metric for understanding businesses’ unit economics. You cannot calculate CLV without knowing your customer churn.

Churn rates can also be utilized to develop strong sales and marketing strategies. Sales teams can better identify and target customers at risk of downgrading or unsubscribing. It enables your software company to focus on methods that increase customer retention and more efficiently allocate time, effort, and spend.

Incorporating churn metrics as part of your regular tracking and reporting on a monthly and annual basis can help your business make short and long-term decisions. Industry peers, buyers, and financial professionals also use your churn rate to analyze your business. A lower churn rate indicates you are meeting customers’ needs and your revenue is stable or growing. These factors are likely to make you more appealing to potential investors or buyers.

How to Calculate Churn Rate

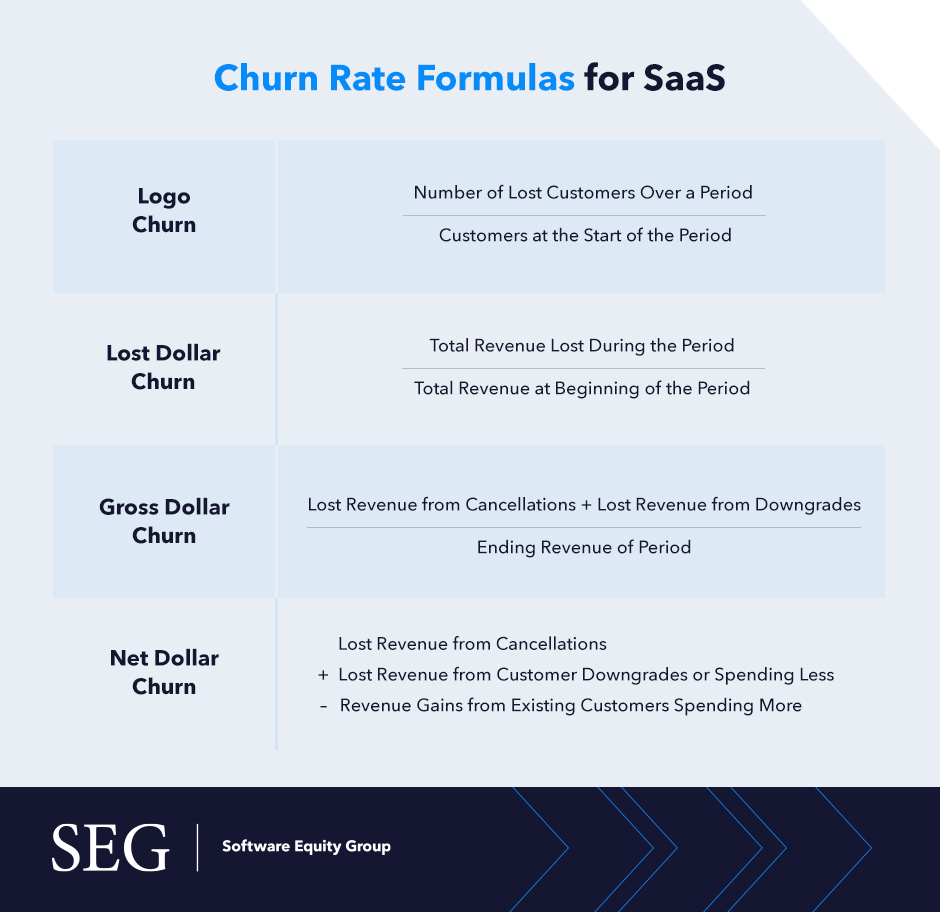

As churn is the inverse of your retention or renewal rate, it’s easy to calculate if this number is available. For example, if you have a renewal rate of 85%, your churn rate is 15%. However, to thoroughly understand churn, it is best to calculate it to gather insights into the different variables that impact it. Below are the formulas to calculate the most common types of churn:

Customer Churn

Customer churn, also called logo churn, accounts for the count of customers you lose over a specific time period. For software businesses, it indicates the percentage or number of subscribers that discontinue their plans. You can calculate customer churn monthly, annually, or for any particular period. Your customer churn percentage is also crucial for determining your customer lifetime value (CLV).

Use this formula to determine your customer churn rate:

Customer churn rate = number of lost customers over a period / customers at the start of the period

If you had 5,000 customers or subscribers at the start of your month, and 4,500 at the end, your calculation would look like this: = (5,000 – 4,500) / 5,000, which simplifies into 500 / 5,000. Leaving you with a monthly customer churn rate of 10%. Your monthly customer churn may differ from month to month and when compared to your annual or quarterly rates.

According to SaaSOptics, a customer churn rate of 10% is considered strong in the SaaS industry and can be used as a benchmark. The lower your logo churn rate is, the better, while higher rates indicate potential problems. Your customer churn rate depends on numerous factors, such as your target customer and market, the price and quality of your product, user experience, and customer service. Since these factors vary within an industry, comparing your rates to companies of a similar size, age, and market is more insightful than a broad comparison of companies in your industry.

Lost Dollar Churn

This type of churn measures the dollar amount (ARR) lost in a given period. To find this churn rate, you divide the total dollar amount lost during the specific period by your total revenue at the beginning of this period. The formula looks like this:

Lost Dollar Churn = total revenue lost during the period / total revenue at beginning of the period

A lost dollar churn of 10% or lower is typically acceptable for SaaS businesses.

Gross Dollar Churn

Gross churn measures the amount of revenue your business loses on a monthly or annual basis from cancellations or downgrades of recurring subscriptions. Your gross dollar churn adds contraction ARR to the lost dollar churn rate. The formula for this metric is:

Gross Dollar Churn = lost revenue from cancellations + lost revenue from downgrades / ending revenue of period

Using gross dollar churn alongside logo churn can help your company understand the type of customers that are churning. You may find that you’re churning more lower-priced subscribers than bigger subscriptions or seeing more downgrades than cancellations. Having more detailed data helps you make better business decisions.

SaaS companies should achieve a gross dollar churn of 15% or lower. Gross dollar churn is viewed by many as the most important churn metric.

Net Dollar Churn

Your net churn rate indicates changes in recurring revenue due to subscription downgrades, upgrades, and cancellations. Many companies use tactics such as cross-selling or upselling to existing customers, which offsets any lost customers or subscription downgrades.

This metric measures the revenue (ARR) churn from your existing customers, including expansion revenue. It includes revenue lost to cancellations and downgrades as well as increased revenue from customer upgrades. You can measure net churn on a monthly, quarterly, or yearly basis. To calculate your net dollar churn, use the following formula:

Net Dollar Churn = lost revenue from cancellations + lost revenue from customer downgrades or spending less – revenue gains from existing customers spending more

If your lost revenue from cancellations is $5,000 and your lost revenue from downgrades is $2,000 while you gain $10,000 from increased customer spending, your calculation will look like this:

Net Dollar Churn = $5,000 + $2,000 – $10,000. Leaving you with a negative $3,000 net dollar churn. Negative net churn, what SaaS companies should aim to achieve, is a growth indicator, showing your company can continue growing without bringing in new customers.

Learn More About SaaS Churn Rates

Understanding your churn rate is critical to the success of your software business. These metrics allow your team to analyze your performance and make changes to improve your churn rate and overall revenue. While some level of churn is unavoidable, knowing which metrics to calculate and analyze is the first step to improving your rate.

Whether you need assistance determining your SaaS churn metrics or interpreting the results, Software Equity Group can help. Use our industry research as a guide or get personalized help from our experienced team.